Five- and six-member self-managed super funds (SMSFs) have only been possible for a few years and the take-up is still relatively low, but clear investment trends are emerging in funds that have embraced the change.

Although the Australian Taxation Office (ATO) reports that just a small percentage of SMSF members have decided to extend their membership, or start funds with larger member numbers, it can be incredibly useful to those members who decide to use it.

Who is using it?

The ATO reported that just 0.1% of the 585,696 SMSFs in financial year 2021–22 had five members with less than 0.1% having six members.

But SMSF Association chief executive officer Peter Burgess says that while the number of SMSFs with more than four members is still small, it appears to be growing steadily.

“I think a major driver is the changing multicultural face of SMSFs. Advisers are increasingly relating how they are seeing a shift from the traditional one or two-member fund, typically Anglo-Celtic with a cultural bias towards a nuclear family structure, to other groups that often exhibit two traits that make an SMSF an attractive option – small business ownership and strong intergenerational relationships,” he says.

2026 SMSF calendar

Our free calendar includes due dates for important documents plus suggested dates for trustee meetings and other strategic issues for your SMSF.

"*" indicates required fields

“Many of these groups have built their wealth via a family business so the opportunity to establish an SMSF, in which their business property can be owned, is a compelling proposition as it allows for the property to be leased back to the next generation – potentially freeing up working capital.”

Recent legislative changes providing greater flexibility around super contributions for retirees up to age 75 has also provided more opportunities for people with businesses to consider the use of vendor-finance as a means of transferring these businesses to children. It has given them a larger window in which to contribute the sale proceeds into super.

What strategies does it open up?

Potential benefits to members could include an increase in investment strategies available to the fund, as the fund has a larger pool of funds at its disposal.

As outlined above, Burgess believes that the ability to purchase business real property is driving an increase in funds with more members and the extra funds those SMSFs now have available gives them extra capacity to do so.

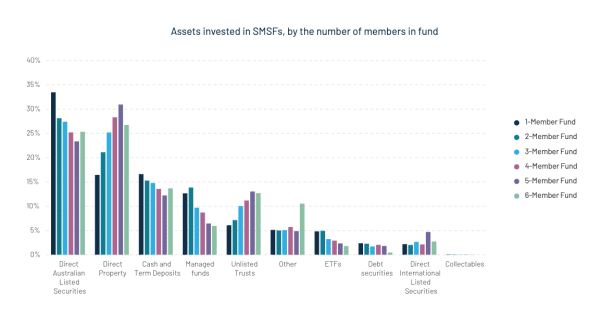

Other data also backs this up. The chart below from the Class Annual Benchmark Report 2022–23 shows that SMSFs with five or six members have lower allocations to direct equities and higher allocations to direct property than funds with fewer members.

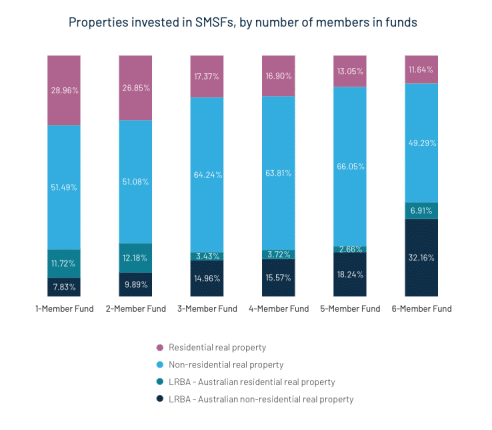

Breaking this down further, we can see that SMSFs with six members have the highest allocation to Australian non-residential real property using a limited recourse borrowing arrangement (LRBA) at 32.16%, while five member funds have the highest allocation to non-residential real property outright at 66.05%.

Free eBook

SMSF investing essentials

Learn the essential facts about the SMSF investment rules, how to create an investment strategy (including templates) and how to give your strategy a healthcheck.

"*" indicates required fields

Chart Source: Class Annual Benchmark Report 2022–23

There are also cost benefits to individuals in multi-member funds. Many costs of running an SMSF – such as the annual auditing fee – are flat dollar amounts, which means the cost per member will reduce as the number of members increases.

Also, if a family has resorted to running two SMSFs to include all members and can now convert to one SMSF, there will be potential administration cost savings.

Disadvantages

One of the potential disadvantages of bigger funds is that there are more people involved in decision-making. This can create indecision and difficulties when members have different attitudes towards risk and differing income needs.

This adds an extra layer of complexity to the investment strategy of the fund, which now has five or six members to consider instead of a single person or a couple.

Of course, the more members in a fund, the more probability that one or more will go through a relationship breakdown and may have to divide their super or withdraw from the fund entirely.

Supercharge your SMSF

"*" indicates required fields

In the case of a family where the children outnumber their parents, there is also the potential for elder abuse, as the younger members could outvote the parents to their potential disadvantage.

The bottom line

Even though take-up so far has been low, the increase in the maximum number of members of SMSFs from four to six is providing more flexibility and investment opportunities for funds that have taken advantage of the change.

Leave a Reply

You must be logged in to post a comment.