In this guide

Life has been somewhat turbulent over the past few years with the pandemic, wars, rising cost of living and decades-high inflation rates, so it’s little wonder we’re all a bit anxious about the future and our finances in particular.

For those yet to reach retirement, there is also the added concern of whether or not you’ve saved enough for retirement and whether what you have saved will last the distance.

While it’s difficult to know the answer to those questions, there are some steps you can take to help reduce your worries and sleep a bit better at night.

Who’s worried about their retirement finances?

Surveys of Australians who are yet to retire have repeatedly found many of us are concerned about both our current finances and having enough when we retire.

A 2023 study for Fidelity and the Financial Planning Association found one in three pre-retirees worry about money daily, while one in two worry at least monthly. They are also the group feeling the least financially capable and much more concerned about running out of money (57%) than those already living in retirement (44%).

These concerns are unsurprising, particularly as we have all been feeling the pinch from the higher cost of living.

A National Seniors Australia (NSA) September 2023 study of almost 6,000 Australians aged 50 and over, found 80% of respondents felt the increased cost of living had impacted their lifestyle, with two-thirds ‘somewhat’ or ‘extremely concerned’ about keeping up with these increases in the long-term.

When it came to worrying about outliving their retirement savings and investments, 53% of respondents felt they were ‘somewhat’ or ‘very likely’ to outlive them.

Younger respondents and those with a lower level of retirement savings were more likely to think they would outlive their savings, with women also more likely to be worried. Those most concerned about the long-term cost of living were more likely to believe they were going to outlive their savings and investments.

Are we worrying unnecessarily?

Although concern about retirement finances is understandable – particularly in light of the recent high inflation rates – running out of money in retirement may not be as likely as many pre-retirees think.

Treasury’s landmark Retirement Income Review – Final Report into retirement incomes found most retirees do not in fact end up using all their retirement nest egg. The report noted most retirees end up leaving the bulk of the wealth they had at retirement as a bequest, rather than spending it all during their retirement years.

These findings are supported by a 2023 study of 1,100 people aged 65 and older by Super Consumers Australia (SCA), which is associated with Choice. It found about 80% of older people feel financially comfortable or are getting by on their current income, with 44% of respondents saying they were living either ‘quite comfortably’ or ‘very comfortably’.

Only 17% of survey respondents were finding it either ‘fairly difficult’ or ‘very difficult’ to get by on their current income. Among retirees in the retirement phase, 61% were only drawing down the legislated minimum from their super, mostly because they didn’t need extra spending money.

The SCA study noted “most are not overly concerned about their ability to afford future health or aged care costs. However, renters, people with a disability and people who no longer have any super report much lower levels of financial comfort”.

9 steps to reduce your anxiety about retirement

If you’re worried about your retirement finances, what can you do to help reduce your stress about having enough money to live well? Here are some ideas to consider:

1. Start planning early

For most people, detailed planning is the key to a successful retirement that doesn’t leave you constantly worrying about having enough income. So, make retirement planning a lifetime process – even when daily life and today’s expenses seem pressing.

Making a plan can make a big difference. According to Vanguard’s How Australia Retiresstudy, more than half (52%) of the people surveyed who were highly confident about their retirement readiness felt they knew what they needed to do to achieve the retirement outcome they desire. People with low confidence in their retirement readiness did not have a plan and felt the most unprepared.

Although not taking action is pretty common, it can lead to regrets. A 2023 report from AMP found three in five Aussies aged 50 and over wished they had started planning for retirement earlier in life, with three in four struggling with the complexity of managing their finances for retirement. More than 40% had no idea if they’ll be eligible for the Age Pension or not.

2. Boost your super savings early in life

Previous research has found retirees receiving income from their super savings are more likely to be unconcerned about their finances in retirement. So, if super income is critical to avoiding worry, start putting a little extra into super as soon as you can.

The Vanguard study found 50% of working-age Australians (those who did not identify as retired) consider super an important component of their retirement plan but expect to rely on it less than existing retirees. More than half of working-age Australians (54%) estimated their super balance constituted 50% or less of their total investments.

Despite the tax advantages of retirement saving through the super system, the report found one in four working-age Australians were unsure of their current super account balance, and one in two were unsure what they paid in super fees.

If you want to reduce your worries about outliving your retirement savings, getting on top of your super could be one of the easiest place to start.

3. Make extra contributions if you’re female

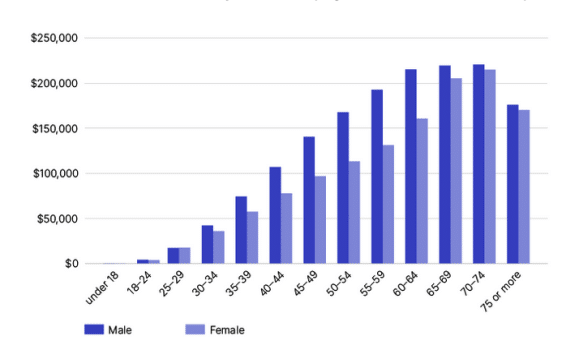

Women retire with less super than men, as they have a lower median super balance at all ages, according to the latest available statistics from the Australian Taxation Office (ATO). At age 60–64, the median super balance for a female is only $158,806, compared to $211,996 for males.

Median super balance by age and sex 2020-21

Source: ATO

This difference in median super balance means women are much more likely to run out of super than their male counterpart of the same age, particularly as, on average, women live longer than men. In retirement, female retirees are also more likely to live in public housing than male retirees and often depend solely on the Age Pension for income.

For women, one of the best ways to overcome these handicaps is to try and add even small amounts to your super account from the start of your career so you take advantage of the benefits of compound interest.

Also consider making voluntary super contributions during any breaks from paid employment (such as maternity leave), if your financial situation permits it.

Women need to plan for their longer life expectancy by saving throughout their career and ensuring they have a good level of financial literacy.

4. Have a sensible saving and spending plan for retirement

Planning your saving and spending in retirement is another way to reduce concern about using up all your retirement resources.

Research in 2023 by SCA found a couple aged 55 to 59 who are outright homeowners and plan to spend an average of $2,654 a fortnight ($69,000 per year) in retirement, only need to have saved $425,000 by age 65. To achieve a similar standard of living, singles wanting to spend $1,808 a fortnight ($47,000 per year) only need save $313,000.

Retiree couples aged 65 to 69 who own their own home outright and want a medium lifestyle (spending around $2,308 a fortnight or $60,000 a year) need to have saved $371,000. Singles wanting the same medium lifestyle (spending $1,577 a fortnight or $41,000 a year), need to have saved $279,000 by age 65.

The SCA savings targets include eligibility for the Age Pension and are in August 2023 dollars adjusted for inflation. Spending figures are based on Australian Bureau of Statistics data about actual retiree spending, so they are likely to provide a pretty accurate picture of retiree expenses.

Take a look at your current household spending and compare it with the figures above. Many people may find they need to save a lot less than they think to enjoy a happy and financially secure retirement.

5. Put away extra to fund health and aged care needs

Most people don’t plan to finance their health and aged care needs in later life, which can be a recipe for anxiety as you get older and your health declines.

Despite this, the SCA study found most older Australians are not overly concerned about their ability to afford future health and aged care costs. When asked how aged care factored into how they managed their money in retirement, 83% of respondents said they were not thinking about future aged care costs.

Of the remainder, 10% said they were spending less so they will have enough money for aged care and 3.8% said they were deliberately withdrawing less from their super so there will be enough money for aged care in some form.

Retirees had a similar attitude towards their future health care costs.

As the government is reviewing the cost of retirees’ contributions towards their aged care, it makes sense to build aged care into your planning if you want to reduce your financial worries in retirement.

6. Focus on your personal relationships and priorities

Having a partner means you are less likely to worry about your future finances than if you’re single, according to a study by the Australian Institute of Family Studies.

Single retiree households also find it hard to make ends meet when it comes to their retirement expenses. According to the NSA study, more single person households (18%) are experiencing severe cost-of-living impacts than couples (13%).

While a partner may make your financial position in retirement a little easier, money is not the only marker of success and happiness. When pre-retirees in the Fidelity study were asked what success in life means, two in five chose being financially successful, while for those actually in retirement, the figure was only one in four.

It’s worth noting retirees in the survey defined success in life as being happy in yourself, doing what you love every day, helping those around you, building quality relationships, and setting and reaching meaningful goals.

7. Talk to a financial adviser or your super fund

Good financial advice can help maintain or increase your retirement savings, reduce your concerns and build your confidence about your readiness for retirement.

Fidelity found Australians who had spoken to a professional adviser had a higher quality of life and were more satisfied with their lives than respondents who had not. Advised people say they are more financially capable and resilient, have a greater sense of meaning and purpose, and are less socially isolated than the unadvised.

Despite these benefits, YouGov research found while 80% of respondents agreed professional financial advice could benefit them in retirement, only 30% had actually sought advice, with women (24%) less likely than men (37%) to seek advice.

Although the cost of advice can be a barrier, Findex projections indicate there are anywhere from 8% to 29% gains to be had from seeking advice, depending on the age you start. The Cost of doing nothing when preparing for retirement report found pre-retirees who sought professional advice are almost three times as likely to say they have a good understanding of the financial resources required for retirement (32% compared to 12%).

8. Consider buying a lifetime annuity

Studies around the world have found retirees with a regular income stream from products like a defined benefit pension or lifetime annuity are less concerned about outliving their retirement savings. The picture is similar for retirees living on income from dividends, rent or business income.

These finding were echoed in a recent Challenger study that found home ownership and ownership of a guaranteed lifetime income (GLI) product were the top two contributing factors associated with a greater sense of retirement preparedness among pre-retirees. However, two-thirds of respondents under the age of 65 report having ‘no knowledge’ of GLI products (such as annuities) and only 8% of those 55 and older claimed to be knowledgeable about them.

If having a reliable source of income that lasts for life can help reduce worry, then unless you are lucky enough to be a member of a defined benefit super fund, buying a lifetime income product could be one way to get some peace of mind about your retirement finances.

9. Don’t worry, and remember there’s a safety net

A clear message from the numerous studies into retiree satisfaction is you worry less about outliving your savings as you get older. Once you are actually retired from the workforce, concerns about money seem to abate.

As Treasury’s Retirement Income Review noted: “Recent retirees generally feel happier than in working life and typically have the same level of satisfaction with their finances compared to just before retirement. They also tend to be less financially stressed than employed people.”

The Fidelity study echoed the view pre-retirees are much more concerned about running out of money (57%), than those living in retirement (44%). Retirees’ top anxiety about the future is losing their independence (52%), while only 38% of pre-retirees are concerned about this issue.

The comforting message from all this is as a retiree you generally learn to adjust to your circumstances in retirement, even if it’s not necessarily what you planned or expected.

It’s also important to remember that if the worst happens and you outlive your savings or they drop significantly in value, the Age Pension is always there as a back-up. Despite scare campaigns to the contrary, no political party has ever suggested removing the Age Pension. The system is tightly targeted to ensure it will always provide a financial safety net for those who need it.

Leave a Reply

You must be logged in to post a comment.