In this guide

The importance of timing has been emphasised by everyone from Shakespeare to modern day business leaders. When it comes to your nest egg, timing is not just important, it can have a major impact on how much you enjoy your retirement years.

If markets drop or prices are volatile, years of careful saving and investing can be wiped away just as you are ready to put your feet up for a well-earned rest.

Although we all hope it doesn’t happen, preparing for the worse is a key part of good retirement planning. An important part of that is learning about the somewhat nerdy concept of sequencing risk.

So, what is sequencing risk?

While it sounds complex, the underlying concept of sequencing risk is the risk your super savings will be subjected to the worst returns at the worst possible time – the years just before and after you retire.

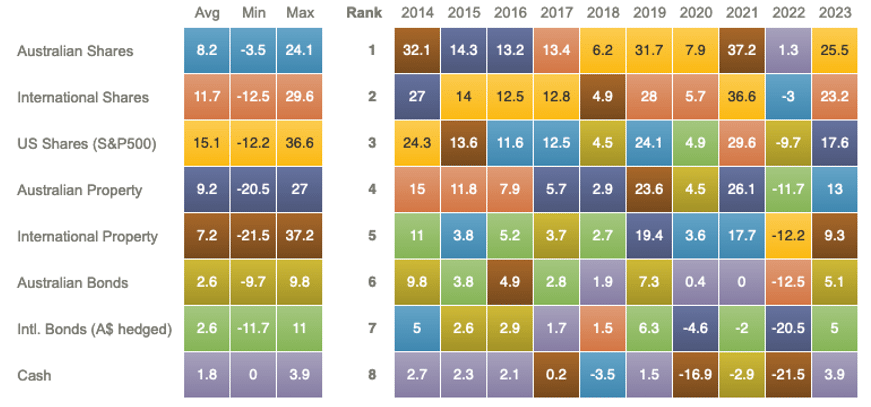

Sequencing risk arises because of the inherently unpredictable pattern of returns delivered by investment markets. You only have to look at the chart below showing the investment returns of different asset classes over the past decade to see this at work.

Annual returns for selected asset classes, ranked in order of performance in each year

Year to 31 December

Source: Vanguard Australia Asset Class Tool

As you can see, investment returns can vary wildly from year to year.

Your investment returns matter even more during the so-called retirement risk zone, which is the period occurring as you switch from building your nest egg to spending it in retirement. During these years your super balance is at its largest, so there’s the greatest amount of money in play. Poor investment returns at this time have an outsized impact on your accumulated savings pool.

Even when you move into retirement you’re not immune to sequencing risk. If you have started a super pension, you’re required to withdraw a fixed, minimum amount from your pension each year – even if financial markets are performing poorly. This means you are being forced to sell units even if the value of the underlying investment assets is low. This effectively locks in your losses, unless you have enough cash set aside in your pension account to ride out periods of volatility.

Why the order of your returns matters

The key issue with sequencing risk is the order – or sequence – in which your investment returns occur.

At the start of your working life you have many years ahead of you to smooth out the ups and downs in investment returns, so the long-term average return is what matters.

But when you’re close to retirement – or in early retirement – the sequence of your investment returns becomes much more important.

For example, if your super account records a negative 12% return early in your working life it’s easier to accept, as your account balance is small and the impact of a 12% reduction isn’t as painful.

But when you’re two years away from retirement that same negative 12% return is going to hurt a lot more. If your account contains 35 years of super contributions and investment returns, a negative 12% return will have a very significant impact in dollar terms. It may also make you think twice about whether you can afford to retire in two years, or whether you will need to work a little longer. This is sequencing risk.

Reversal of fortunes: Andy and Amal’s very different journeys to retirement

At age 51, Andy and Amal both had $100,000 in their super accounts. They each decide to contribute $20,000 a year into their account over the next nine years, at which point they both plan to retire.

Over that period, they both have an average investment return of 7% per year. When they come to retire, however, they will have very different amounts in their super account due to the order in which they received their investment returns:

| Year | Annual contribution | Andy’s investment return | Andy’s super account balance | Amal’s investment return | Amal’s super account balance |

|---|---|---|---|---|---|

| 0 | $100,000 | $100,000 | |||

| 1 | $20,000 | 25% | $150,000 | -20% | $96,000 |

| 2 | $20,000 | 19% | $202,300 | 16% | $134,560 |

| 3 | $20,000 | -18% | $182,286 | 21% | $187,017 |

| 4 | $20,000 | 24% | $250,834 | -18% | $169,754 |

| 5 | $20,000 | 17% | $316,876 | 17% | $222,012 |

| 6 | $20,000 | -18% | $276,238 | 24% | $300,094 |

| 7 | $20,000 | 21% | $358,448 | -18% | $262,477 |

| 8 | $20,000 | 16% | $439,000 | 19% | $336,148 |

| 9 | $20,000 | -20% | $367,200 | 25% | $445,185 |

| Average annual investment return | 7.3% | 7.3% |

Although Andy and Amal had the same average investment return over nine years and their contributions were the same, Amal retires with $77,985 more than Andy at retirement due to the order in which they received the investment returns. Andy experiences his biggest annual loss of 20% in the year before he retires, whereas Amal has a 20% loss in the first year of her nine-year plan.

Although Andy and Amal had the same average investment return over nine years and their contributions were the same, Amal retires with $77,985 more than Andy at retirement due to the order in which they received the investment returns. Andy experiences his biggest annual loss of 20% in the year before he retires, whereas Amal has a 20% loss in the first year of her nine-year plan.

5 ways sequencing risk affects your retirement

1. Less money in super when you retire

If your super account experiences a run of poor investment returns when you’re close to retirement and your nest egg is at its largest, you are likely to have less super than you planned when retirement day rolls around.

Learn about spending in retirement.

2. More investment risk required

When you’re close to retirement, there’s less time for your super account balance to recover from a loss, compared to someone who has just started saving. As a result, you may feel compelled to take more investment risk to try and recoup your losses.

Learn about changing your investment option.

3. Enforced changes to your retirement plans

If investment returns are negative just before you plan to stop working, you may be forced to delay your retirement. Investment volatility due to the GFC and the COVID-19 pandemic reduced the retirement savings of many pre-retirees and they found they needed to continue working for longer than they had originally planned.

A significant market correction during early retirement can also force you to return to work to rebuild your savings. At the very least, you may need to reduce your spending, forgo travel or make different lifestyle choices.

Learn how much super you need.

Check out how annuities can help.

4. Less money invested during retirement

With less money in your super account when you retire, you will have a reduced amount invested and earning compound returns in future. Some estimates are as much as 60% of every dollar of retirement income comes from the investment earnings you make after you retire and start a super pension.

Learn about the 10/30/60 retirement income rule.

5. Bigger chance of running out of money

If you’re unlucky and investment returns are poor when you begin drawing down retirement income, your super is likely to run out faster. With less capital available, your risk of outliving your savings increases.

Learn about your life expectancy.

Strategies for dealing with sequencing risk

Yes, you can plan your retirement without a financial adviser

- Step-by-step guides help you plan and take action

- Simple changes can make a big difference to your super balance

- Calculators, case studies and Q&As give you greater confidence

- Make sure your super is performing and lasts longer

Leave a Reply

You must be logged in to post a comment.