In 2022, the OECD recommended all countries build retirement products that provide some level of longevity protection as a default for the pay-out phase.

“Lifetime income can be provided by annuities with guaranteed payments or by non-guaranteed arrangements where longevity risk is pooled among participants. The choice of the type of arrangement will depend on the desired balance between the cost of guarantees and the stability of retirement income. Flexibility could be provided by allowing for partial, deferred or delayed lifetime income combined with programmed withdrawals. Full lump sums should be discouraged in general, except for low account balances or extreme circumstances.”

One such product is an investment-linked annuity.

What is an investment-linked annuity?

An investment-linked annuity is a lifetime income stream where your income payments are guaranteed to continue for life but the level of those payments varies over time to reflect the performance of the chosen investment option(s).

This represents a new breed of retirement income product in Australia. Investment-linked annuities provide longevity protection to ensure the retiree never runs out of money but also offer a choice of investments used to support that income. This design provides an opportunity to benefit from market returns over time. The longevity protection is provided by way of insurance.

Free eBook

Retirement planning for beginners

Our easy-to-follow guide walks you through the fundamentals, giving you the confidence to start your own retirement plans.

"*" indicates required fields

Why have these been developed?

In 2014, the Financial System Inquiry (FSI) concluded that account-based pensions (ABPs), used in isolation, cannot efficiently convert superannuation assets into retirement income.

Modelling by the Australian Government Actuary (AGA) showed that retirement income can be 15–30% higher by combining retirement products, particularly by allocating some money to a lifetime income product.

These conclusions were endorsed by the Retirement Income Review and Treasury proposals for the Retirement Income Covenant. They are also consistent with OECD recommendations for designing retirement systems.

The main problem with allocating 100% of your superannuation to an account-based investment in retirement is you don’t know how long you are going to live. This means you don’t know how much income you can safely withdraw each year. A growing body of research indicates that Australian retirees have a “fear to consume”, as the majority of superannuation funds only offer account-based pensions (ABPs) in retirement. Many retirees respond by only withdrawing the compulsory minimums each year, which means a relatively large balance is left unused on death.

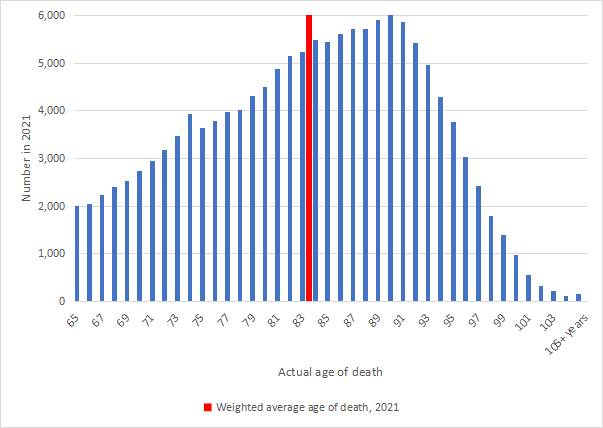

Retirees’ concerns over how long they could live are valid. Chart 1 shows the actual age at death for Australians aged 65 or more who died in 2021. It demonstrates how retirees simply can’t tell how long their retirement timeframe is.

Chart 1: Actual age of death for all Australians who died during 2021 aged 65 or more

Other research indicates that age of parents’ death may not be a good indicator of the age of the retiree’s death, as causes of death may differ and new medical treatments continue to extend life expectancy.

Over 2,000 years ago, the Romans solved this problem by using the annuity — probably the oldest financial product in the world. Annuities remove the risk of running out of money and mean you can confidently spend your entire income. US studies show that retirees on lifetime incomes (e.g. annuities) exhibit higher levels of satisfaction in retirement, even taking the wealth effects into account.

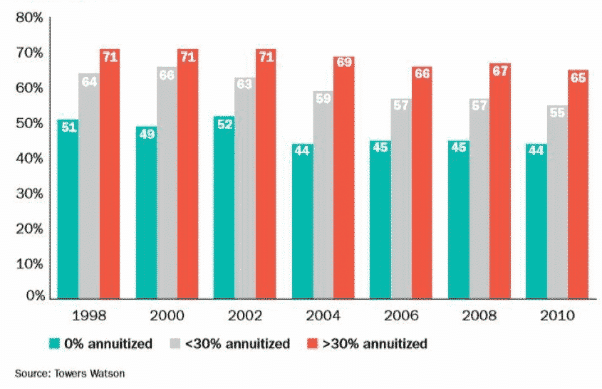

Chart 2 is based on a University of Michigan study of over 20,000 retirees. It shows that those who annuitised part of their retirement savings have higher levels of retirement satisfaction than those who did not.

Chart 2: US retiree satisfaction rates by extent of annuitisation, full sample, 1998–2010

Many financial professionals, however, baulk at the current cost of traditional annuities. These annuities are often perceived as poor value for money. But part of the pricing of a traditional annuity is not just insuring longevity risk but also providing investment guarantees — often for 30 or more years into the future — and these are very expensive to provide.

But what if lifetime annuities didn’t need to include investment guarantees? What if retirees with a balanced attitude to risk could still benefit from the longevity protection but maintain some exposure to growth assets — as they do with an account-based pension. For these retirees, the ideal retirement product could be an investment-linked annuity (or real lifetime pension), that is, an ABP with longevity protection that doesn’t decline in real terms over time.

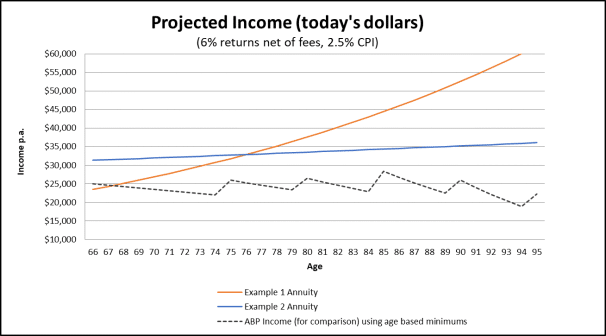

With an investment-linked annuity, each year’s income varies based on the performance of a selected investment option, rather than as a specific dollar amount of income.

Chart 3: Projected income from each example (in today’s dollars) compared with an ABP

Decision factors

- An investment-linked annuity can provide George with confidence to spend in retirement as he cannot outlive his income.

- However, the income level changes over time based on the returns of the investment fund – like mainstream super products.

- Most annuities offer a death benefit period — where a lump sum is payable to help protect the customers capital in the event of early death.

- Many also offer a spouse’s option – so if one spouse passes away the income continues for the remaining lifetime of the survivor.

- By agreeing to modify the annuity, George can achieve a higher income at inception, which then increases more in line with a CPI target (as opposed to a lower income that increases with full net returns).

- Choosing an investment-linked annuity with a suitable exposure to growth assets can help deliver an efficient lifetime income and offset the effects of future inflation.

- It’s possible for an investment-linked annuity to offer investment choice including a switching process.

This article is an introduction only. Investment-linked annuities, and equivalent lifetime pensions from superannuation funds, are likely to be an increasing part of the superannuation landscape as the Retirement Income Covenant moves forward.

Supercharge your retirement

Get pension and retirement tips and strategies with our free monthly newsletter.

"*" indicates required fields

These products provide an alternative to traditional annuities, which many investors view as having poor value. They add confidence when used in conjunction with account-based pensions, which pass all risk to the retiree.

Centrelink means-test incentives were put in place for these and other lifetime income streams from 1 July 2019. This can provide an instant uplift in age pension income for retirees subject to means testing.

Investment-linked annuities could be very attractive to older or bereaved members of a self-managed super fund (SMSF) who no longer want to manage their own super assets and are happy for professional investment managers to do that on their behalf. This gives them less responsibility regarding investment and longevity risk, and more time to enjoy their retirement, with much less stress about running out of money — which is what retirement should be all about.

Jim Hennington, Peter Rowe and David Orford are from Optimum Pensions.

Leave a Reply

You must be logged in to post a comment.