In this guide

If you have suffered a Total and Permanent Disability (TPD), you may be able to claim on any TPD insurance you have through your super. If the claim is successful, the TPD benefit is paid into your super account (as an unrestricted non-preserved benefit) and combined with your existing super balance.

Once you meet the TPD claim definition, you are most likely to meet the ‘permanent incapacity’ condition of release. This means that if you have been permanently incapacitated due to physical or mental illness, you can access all your super from all your accounts (if you have multiple accounts) regardless of your age, provided you meet certain criteria.

First, let’s understand the tax impact of making a lump sum withdrawal from super.

Tax on lump sum withdrawals

The information below relates to taxed super funds (the most common type).

If you are under 60 and withdraw a lump sum from your super account, tax will apply on the taxable component of that withdrawal. If you are under the preservation age (currently between 55 and 60 depending on your date of birth) the tax rate is 22% (including Medicare levy); or 17% (including Medicare levy) on the portion of the taxable component that is above $235,000 (in 2023-24) if you are over the preservation age but under 60. If you are over age 60, withdrawals are tax free.

Now, let’s understand the tax impact of making lump sum withdrawals from super after a TPD claim using a case study.

Tax impact of a TPD claim inside super

Darren’s case study:

- Darren is 45 (born July 1977) and has been approved for a TPD claim of $300,000 inside his super fund.

- He stopped working on 1st January 2022.

- He does not have any other super fund. His current super account was established when he started his first job.

- His super fund balance (prior to the TPD payout) was $200,000 and is fully taxable (no tax-free component).

- His super account’s eligible service date is 1 July 2005.

- He plans to withdraw the full $500,000 over the next few years in lump sum instalments.

Initially, Darren’s TPD payout will form part of his taxable component. However, if he withdraws a lump sum amount or rolls over his super to another super fund, there will be an increase in the tax-free component called the ‘tax-free uplift’.

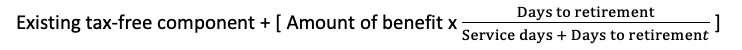

For Darren, the new tax-free component is determined by the following formula:

- Existing tax-free component = current tax-free component of your super account

- Amount of benefit = lump sum amount you plan to withdraw (usually the TPD amount and super balance)

- Days to retirement = number of days between the day you stopped being capable of being gainfully employed until your retirement day (generally age 65 if uncertain)

- Service days = number of days from the eligible service date to the date you stopped work.

Your Eligible Service Date is the earlier date of either:

- The date you commence your super account

- The date the super account was set up

- The earlier eligible service date is always retained if multiple super accounts are consolidated.

In Darren’s case:

- Existing tax-free component = $0

- Amount of benefit = $500,000

- Days to retirement = 7,486 (days between 01/01/2022 and age 65 on 01/07/2042)

- Service days = 6,028 (days between 01/07/2005 to 01/01/2022).

Therefore, the new tax-free component is $276,972.

| If retained as is within current super fund | If fully withdrawn or rolled over into another super fund | |

|---|---|---|

| Taxable component | $500,000 | $223,028 |

| Tax-free component | $0 | $276,972 |

If Darren withdraws the full $500,000, 22% tax on the taxable component would amount to $49,066 ($223,028 taxable component @22% tax = $49,066.16).

But one very important point to note is that as Darren is not planning to withdraw the full amount in one go. This could mean he ends up paying unnecessary tax if he leaves the balance of his TPD payout in his current super fund and makes other withdrawals later.

When he makes another withdrawal in the future, his super fund can ask him for updated medical certificates to ensure he still meets the ‘permanent incapacity’ condition of release. If Darren is unable to provide the certificates, or if he has commenced employment again, he will have to pay the 22% tax rate on the full withdrawal and not receive the ‘tax-free uplift’.

Benefits of a rollover strategy

To lock in this tax-free uplift, one of the most common strategies is to rollover your current super fund into another super fund.

When Darren rolls over into another super fund, it will be classified as a disability payment. His current super fund will provide the new tax-free and taxable component details to his new super fund. This way, Darren will get to lock in the tax-free component of $276,972 with his new super fund.

So, Darren can make future lump sum withdrawals from his super at any time and have the new tax-free component locked in, even if he starts working or cannot provide medical certificates.

If you have multiple super accounts

The above case study is based on a member having only one super account.

If Darren had another super fund with a $5,000 balance, an eligible service date of 01/07/1997 (an earlier date than his main super fund with the TPD claim) and he rolled this $5,000 super fund into his main super fund, the eligible service date would change from 01/07/2005 to 01/07/1997.

This would increase the taxable component and the result would be that Darren would have to pay tax of $60,498 (based on the combined $505,000 super balance). To avoid this, Darren could keep his two super accounts separate.

The above case study is one of the ways to help manage the tax payable on a TPD payout. There are other potential strategies as well, including commencing a disability income stream, so you should consider consulting a financial adviser to help with your specific situation.

Get more guides like this with a free account

better super and retirement decisions.

Leave a Reply

You must be logged in to post a comment.