In this guide

As we look back over the 2018-19 financial year, it was a year in two halves.

Spooked by falling global growth and an escalating trade war between the US and China, financial markets slammed on the brakes heading into Christmas. Then, despite a lack of real progress on the economic or trade front, markets flicked a switch to full steam ahead in the first half of 2019.

All in all, it’s been a good year for super with funds posting their 10th straight year of positive returns. According to Chant West, the median return for growth options was around 7%.

So what just happened?

Table 1: Financial year returns

| Shares | |

|---|---|

| MSCI World Index | +4.3% |

| S&P500 | +7.9% |

| S&P/ASX200 | +6.8% |

| Bond yields | |

| US 10-year bond | -0.9% |

| Aust 10-year bond | -1.3% |

| Currency | |

| $A vs $US | -5.1% |

| Commodities | |

| Iron ore | +83% |

| Oil | -21% |

| Gold | +13% |

| Property | |

| CoreLogic Home Value Index | -6.9% |

Economic growth falters

The global economy has slowed over the past year as the trade war between the US and China began to bite.

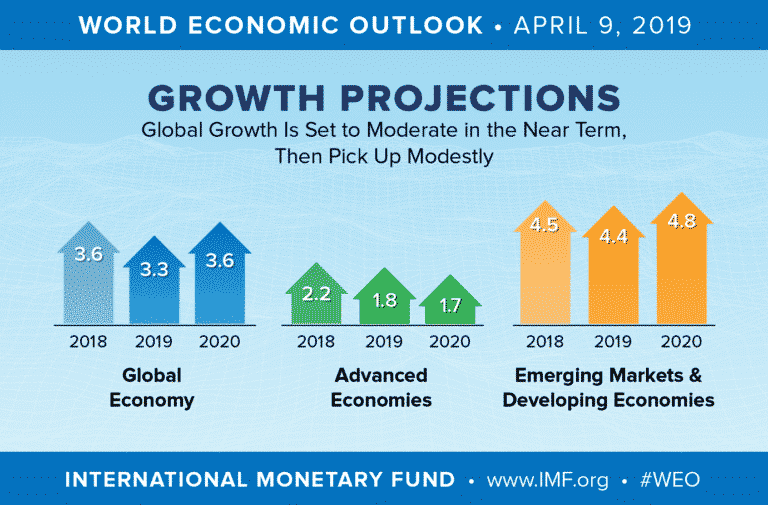

After solid growth in 2017 and early 2018, the International Monetary Fund forecasts global economic growth to slow to 3.3% in 2019 before recovering modestly to 3.6% in 2020.

While Australia continued its world-beating run of economic growth, with a record 28 years now completed, strains are beginning to appear. Our economy is currently growing at an annual rate of 1.8%, the slowest in almost a decade.

A truce of sorts in the ongoing trade war was declared at the G-20 meeting in the dying days of June, but it was more a temporary cessation of hostilities.

The two sides have agreed to keeping talking and President Trump agreed to delay plans to impose 25% tariffs on a remaining US$300 billion in Chinese imports not yet caught in the levy.

Markets breathed a sigh of relief and ended the year on a positive note, but the war of words and global trade tensions are far from over.

Global central banks, including our own, are perplexed by stubbornly low inflation and increasingly frustrated with a lack of political action to stimulate flagging economies. In response, they are reaching for the only lever they have and cutting interest rates.

Falling interest rates

The Reserve Bank of Australia cut the cash rate by 25 basis points in June to a new record low of 1.25% (followed by another cut to 1.00% in July 2019). This was the first interest rate move since August 2016. The RBA cited concerns about the slowing economy, stagnant wages, drooping inflation and stubbornly high unemployment.

Inflation fell to 1.3% in the March quarter, well below the RBA’s target band of 2-3% while unemployment is stuck around 5.2%. By contrast, US unemployment is at a 49-year low of 3.6% and the last inflation reading was 1.6%.

Yields on Australian 10-year government bonds fell 1.28% over the financial year to 1.34%, roughly level with inflation. At that rate, investors are receiving no reward for holding bonds to maturity.

Despite a fall in US long bond yields to 2.0%, the differential between local and US bond yields grew in 2018-19 but that could be about to change. US Federal Reserve chair Jerome Powell said in June that the case for somewhat lower rates had strengthened.

Weaker Aussie dollar

The Aussie dollar fell 5.1% over the last financial year to US70.2c, after starting the year around US74c.

The weaker local currency is due to the resurgent US dollar and the widening interest rate differential between the two countries. The falling dollar is good news for Aussie exporters and companies with overseas operations.

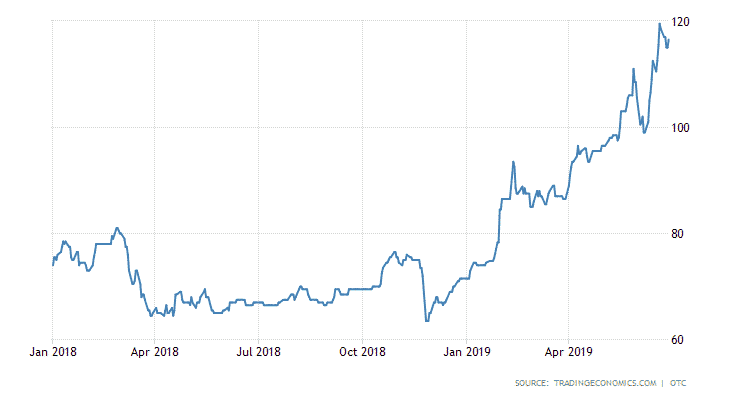

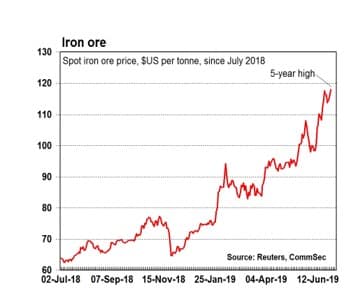

Iron ore price surge

Against a backdrop of weaker commodity prices due to slower global growth, iron ore has bucked the trend. The price of the steel-making ingredient surged 58% in the six months to June (83% for the year) after January’s tragic dam disaster in Brazil forced Vale, the world’s biggest iron ore producer, to cut production.

Graph: Iron ore (US$ per tonne).

At the same time, Chinese demand increased due to the government’s economic stimulus and new housing starts. Australia is a major beneficiary, with record imports and exports from China contributing to a record overall trade surplus of $37.7 billion in the year to April.

Oil prices fell 21% over the year but jumped 27% in the six months to June as the US imposed economic sanctions on Iran. Until recently, Iran was the world’s second biggest oil producer after Saudi Arabia but has lost that mantle to Iraq.

Rising geopolitical tensions also lifted the price of gold by 13% to US$1,406.60 an ounce.

Source: Commsec Financial Year Wrap: 2018-19

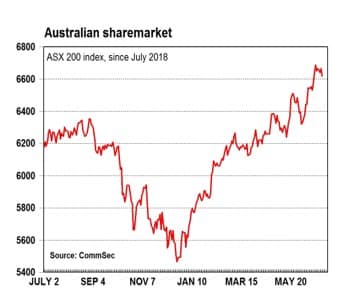

Shares rebound

Global shares surged 15.2% in the first half of 2019 to post a gain of 4.3% for the year. The US S&P500 Index was up 18% in the latest half and 7.9% overall.

Australia followed the trend, up 17.1% in the first half of 2019 and 6.8% over the financial year. Total returns (including dividends) are near record highs, up 11% over 2018-19.

Source: Commsec Financial Year Wrap: 2018-19

The local market finished strongly once the May federal election was out of the way and the threat to cash refunds of franking credits was removed.

Higher iron ore prices, the lower Aussie dollar and falling interest rates were all positive for local shares. That fired up shares of producers including Rio Tinto (+29%), BHP (+26%) and Fortescue Metals (+135%) although falling oil, natural gas and thermal coal prices hit energy stocks.

Despite a world of worries for consumers reflected in soft retail sales, falling bank interest rates and flatlining wages, the best performing sectors were telecoms (+43%) and consumer durables and apparel (+41%).

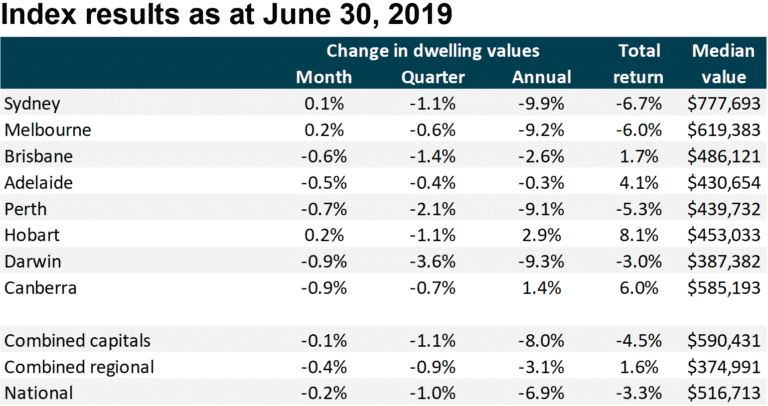

Housing downturn loses momentum

Residential property prices continued to fall in 2018-19 but by June there were signs that sentiment was improving in the key markets of Sydney and Melbourne as lower mortgage rates stimulate buyer interest.

According to the CoreLogic Home Value Index, national home prices fell 6.9% in the year to June, with Sydney, Melbourne and Darwin all down by more than 9%. Only Hobart and Canberra bucked the trend with rises of 2.9% and 1.4% respectively.

The best rental yields in the final quarter were in Darwin (6%); Sydney had the lowest yields of 3.5%.

Source: CoreLogic Home Value Index

Looking ahead

If the last financial year has taught us anything, it is that forecasting financial markets is a mugs’ game and that sentiment can change in an instant.

Australia, like the rest of the world, faces headwinds from a slowing economy, fallout from the ongoing trade war between the US and China and escalating tensions between the US and Iran.

The Reserve Bank is doing its bit by lowering interest rates, but it is calling on the government to do more than cut taxes to stimulate the economy. Even the Bank of International Settlements (BIS), known and the central bankers’ bank, recently called on governments to increase spending rather than rely on monetary policy to dig the global economy out of a hole.

So far, the calls are falling on deaf ears.

But there are positives as we start a new financial year. We have three years before the disruption of a federal election. Falling interest rates and the continuation of negative gearing should help the property market hit bottom sooner than expected. And the hunt for yield in a low interest rate world should support local shares.

Leave a comment

You must be a SuperGuide member and logged in to add a comment or question.