In this guide

Since 2021, three major superannuation funds and three insurance companies in Australia have introduced innovative retirement products. These offerings constitute a whole new category of retirement solutions. The impetus behind these new products is the government’s desire to address the “Fear Of Running Out” (FORO) reported by many Australian retirees.

As a result, retirement products are no longer limited to either an account-based pension (ABP) or a guaranteed lifetime annuity. They are a hybrid of both.

The new category of products provides lifelong income sustainability so that even if you live far beyond your life expectancy, your retirement income won’t run out. However, instead of a fixed level of income, the new products define the income level based on a set of rules. This allows an increasing range of retirement product designs.

New products can include options for higher income which can fluctuate over time based on the performance of the product’s investments or other design features.

For example, an investment-linked annuity design has been highly successful in the United States with one of the world’s largest retirement plans offering this approach since 1952. Other superannuation funds in Australia have indicated they’re likely to offer new lifetime products too.

The following case study is from the book Retirement Income for Life: Solving the longevity equation, written for financial planners by actuaries and superannuation specialists David Orford, Peter Rowe and Jim Hennington. It has been reproduced with the agreement of the authors.

The case study illustrates how product combinations that include an innovative retirement income product can deliver superior outcomes that align with a retiree’s unique retirement objectives, risk preferences and circumstances. Blending products allows financial planners to develop integrated strategies that can maximise sustainable income while allowing flexibility, giving retirees the best of both worlds.

Case study: Blending retirement products

Vanessa and Simon plan their retirement

Vanessa and Simon are both aged 67. They are married. They have two adult children, Christopher and Laura. They approach their financial planner, Marie, for help with their retirement planning.

They own their own home, worth about $2 million. Vanessa has $450,000 in super. Simon has $700,000 in super. They have private savings of $75,000 and other personal assets of $25,000. They do not intend to make a specific bequest to their children as they don’t need it.

Health

Vanessa is in good health. She keeps fit by walking and playing tennis. Simon plays golf about once a month. Vanessa’s parents lived into their late 80s. Simon’s mother lived until 92, but his father developed dementia in his late 70s and died of a heart attack at 84.

Simon is on medication for the management of his high cholesterol and high blood pressure.

They understand that, while Vanessa is healthy, it is sensible to consider that Simon may be more susceptible to physical and cognitive decline as he gets older.

They also want to have certainty that if their health deteriorates as they get older, they will have security of income.

Retirement lifestyle

In response to Marie’s question about what their expectations are in retirement, Vanessa and Simon explain they want to enjoy their early retirement while they are still active and healthy but without fear of exhausting their savings later in life. They would like an overseas holiday every year for the next five years and maybe do some travel around Australia.

They plan to stay in the community they have lived in for the past 20 years; where they have friends and will be close to their children and grandchildren. They want to maintain their independence for as long as they can and are prepared to move into a retirement village when they are older.

They are both looking forward to a comfortable retirement. Simon would like not to have to worry about money in retirement — particularly as neither of them have investment skills or knowledge. He likes certainty and is particularly keen to make sure that Vanessa can live comfortably later in retirement if he dies before her.

Longevity

Marie takes them through the Optimum Pensions LifeSpan Calculator (available on SuperGuide here). Both agree that while they are willing to accept some investment risk, they want their plan to be long enough to cover their lifespans. A key takeaway for Simon is that, even though he is on blood pressure and cholesterol medication, these are now manageable conditions, which means it is prudent for him to consider that he may still live a long life.

Vanessa and Simon LifeSpan Calculator

| Vanessa | Simon | |

|---|---|---|

| Gender | Female | Male |

| Age | 67 | 67 |

| Marital status | Partnered | Partnered |

| Working status | Still working | Still working |

| Planned retirement age | 67 | 67 |

| Degree of desired confidence that their retirement plan is long enough | 90% | 90% |

| Suggested planning age: Australian Life Tables with improvements (90% confidence) | 100 | 99 |

| Height (cm) | 161 | 170 |

| Weight (kg) | 71 | 95 |

| Exercise | Regularly | Little or never |

| Smoke | No | No |

| Fruit and vegetables | Regularly | Regularly |

| Manual labour | No | No |

| Health | No issues | High blood pressure and high cholesterol |

| Alcohol | Occasionally a little | Regularly |

| Superannuation (used as a proxy for relative wealth) | Combined, they selected the 2nd highest band* | *(based on their balances and ages) |

| Suggested planning age (using the personalised Optimum Pensions LifeSpan Calculator) | 103 | 100 |

The calculator shows that, as a couple, they’ll need their planning horizon to last slightly longer than either of their individual results. Using the Australian Life Tables, to have a 90% confidence level that their plan will cover as long as either of them could live, Simon and Vanessa should plan for their retirement income to last for 34 years up to age 101. If they take their personal health and lifestyle characteristics into account, this extends to 36 years (age 103).

They agree to plan for 36 years but understand that either of them could live longer or shorter than this. This aligns with wanting 90% confidence that their plan is long enough.

Income needs

Marie then works through a budget for Vanessa’s and Simon’s retirement. They agree to plan for an income of $90,000 a year, which will allow them to meet their lifestyle needs of $70,000 a year and give them an extra $20,000 a year for discretionary spending, such as meeting their travel plans and undertaking their leisure activities.

They anticipate they will be more active in their early years but still want to maintain the higher income to cover future changes in how they live and if their health deteriorates.

Capital needs

They want to have some accessible money available:

- As an emergency fund to cover unexpected hospital and medical costs

- For maintaining their home.

They are prepared to sell their house if it becomes necessary to move into a retirement village or an aged care facility.

Estate planning

Vanessa and Simon think they have earned their retirement and they deserve a comfortable lifestyle. It would be nice to think that they can leave money to their children, but this is not their main priority. They weren’t left much by their own parents, and they have already assisted their children in getting established. The first partner to die will leave their estate to the surviving partner, including the reversionary income from their income stream. On the death of the second partner, the estate will be left in equal shares to their children.

Investment risk profile

Marie takes them through her risk profiling process. They agree that they are investing for the long term and would like to have an allocation of 60–70% in growth assets and the remainder in defensive assets. They understand that there will be fluctuations in the investment returns and possibly negative returns in some years, but they are prepared to accept that to achieve higher returns over the long term.

Scope of advice

Marie explains the range of retirement income products available to them and the advantages and disadvantages of each. They discuss that their retirement needs are unlikely to be satisfied by a single-product solution. They will need to consider making trade-offs between both spending money earlier in retirement and having enough to meet their needs later in life. This may mean they need to adjust their spending over time if their investment returns are lower than expected. Marie advises that, after she has completed her research, she is most likely to recommend a combination of an investment-linked lifetime income stream and an ABP to meet Vanessa and Simon’s desired lifestyle.

Vanessa and Simon agree to a comparison of an ABP and an investment-linked annuity (ILA), one of the new types of retirement product in Australia.

Vanessa will provide a recommendation as to the most appropriate combination. These products are chosen as the ABP will provide some income but also access to cash if needed for many years while the ILA will provide a lifetime income. They want to understand how much income they can expect to receive in retirement, how much their income might vary from year to year, and what the income would be when one of them dies before the other.

Conducting research as a basis for recommendation

Marie works with her paraplanner to prepare a plan for Vanessa and Simon.

They agree to look at three options:

- Investing all their $1,150,000 superannuation in an ABP invested in a balanced option

- Investing all their $1,150,000 superannuation in an ILA invested in a balanced option

- Both Vanessa and Simon combining an ABP with an ILA, both invested in a balanced option.

They would like a before-tax income of $90,000 a year to cover their basic needs and for discretionary spending — all in real terms (i.e. will need to grow in line with inflation).

When looking at ILA products, some providers offer the ability to set a higher income earlier in retirement in exchange for having a lower rate of increase (than the investment return) in their annual income each year. This suits Simon and Vanessa as they will be most likely to spend more earlier in retirement when they are travelling. They agree to the option where their future rate of increase in ILA income is reduced by 2.5% per annum. This would mean they get a higher starting level of income (with a slower rate of increase). For example, if the net return on their investment choice was (say) 6% per annum, then their income would only increase by 6%, reduced by 2.5% each year or approximately 3.5% per annum on average each year**.

The higher starting income from the ILA provider then increases more slowly than if the full 6% per annum increases applied. Vanessa and Simon’s expected increases might better match rates of inflation over the long term.

Marie assumes that the ABPs have administration and investment fees of 0.6% a year. The fees of 1.2% a year for the ILA product are made up of 0.9% in administration and longevity insurance fees and 0.3% per annum for investment fees.

When it comes to the Age Pension calculation, both their $1,150,000 super and $75,000 personal assets are taken into account. They assume that both the maximum Age Pension and the thresholds for the income and assets tests keep pace with inflation over time.

On the basis of the LifeSpan Calculator, they agree to prepare figures up to Vanessa’s age 103, based on the 90% confidence level they had agreed. There is only a 10% chance of one of them living longer than age 103 based on their current attributes.

Using the Retirement Income Calculator as the basis for their calculations, Marie allows for a 65% reversionary pension for Vanessa if Simon dies prematurely and a 50% reversionary pension for Simon if Vanessa dies prematurely. The reversionary rates were chosen as both Vanessa and Simon believe that if either of them is the only one alive, they expect to have enough income to support their single lifestyle but want to see the results of Marie’s calculations. To develop a recommendation for Vanessa and Simon, Marie calculates the following scenarios:

- 100% of the superannuation invested in ABPs

- 100% of the superannuation invested in ILAs

- Splitting their investments by Vanessa investing $250,000 in an ILA and $200,000 in an ABP and Simon investing $450,000 in and ILA and $250,000 in an ABP.

When combining products, and after considering the various alternatives, Simon and Vanessa settle on a combination of 40% investment in an ABP and 60% in the ILA product.

The results of their three scenarios are shown below.

Retirement strategy scenarios

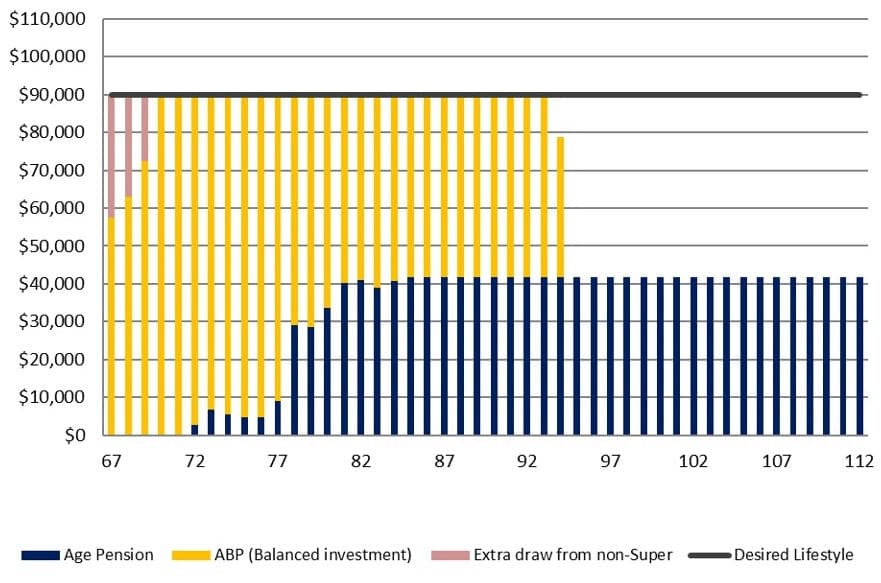

Option 1: Vanessa and Simon invest 100% of their superannuation in ABPs

Retirement income breakdown (today’s dollars)

In this scenario, Vanessa and Simon are assumed to make withdrawals from superannuation to meet a total spending level of $90,000 per year, linked to price inflation. The projection above shows they would be able to spend this amount until age 93 years, reducing to just under $80,000 at age 94 years. But then the ABPs would run out and they would then only have the Age Pension to live on; this is short of the target planning age of 103.

The whole of an ABP is assessed for the Age Pension means test but they would not qualify for any Age Pension until age 72. As you can see, as more income is drawn down from the ABP and the balance of the ABP reduces, a part Age Pension would become payable and then increase.

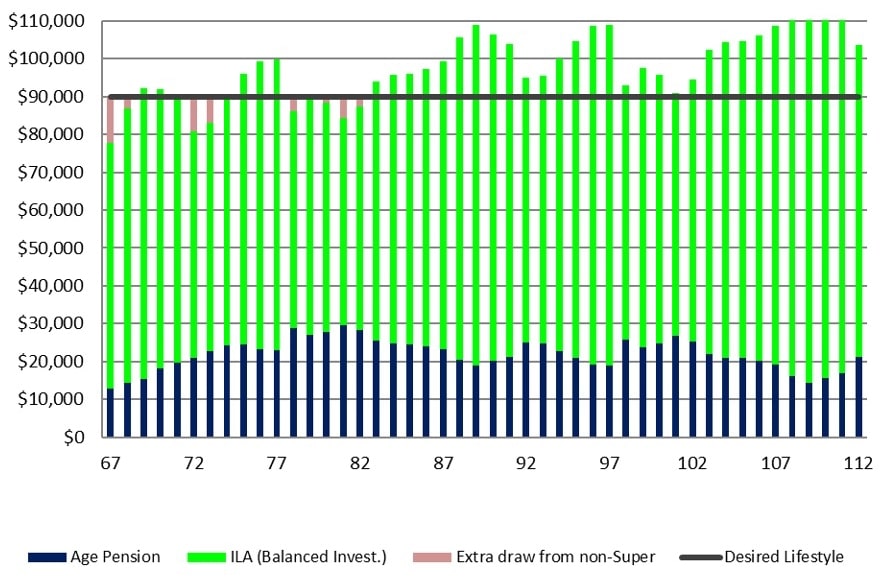

Option 2: Vanessa and Simon invest 100% of their super into an ILA

Retirement income breakdown (today’s dollars)

By investing the whole of their superannuation balances in ILAs then (based on this return sequence), they would be able to meet their planning target of $90,000 per annum to age 103 years and beyond. The income would continue after that age until they pass away. However, this does not leave them with as much access to cash in the case of emergencies. Emergency funds may need to come from any savings that can be made from their income.

The lifetime income streams receive concessional treatment under the Age Pension means test and this allows them to immediately qualify for an Age Pension but in the latter years it would be lower than under Option 1 (where their savings are exhausted).

The basis for this calculation was to allow for Vanessa to receive 65% of Simon’s lifetime income stream should he die before her, and Simon would receive 50% of Vanessa’s lifetime income stream should she die before him. As mentioned above, they consider this would allow either of them to meet their ongoing needs.

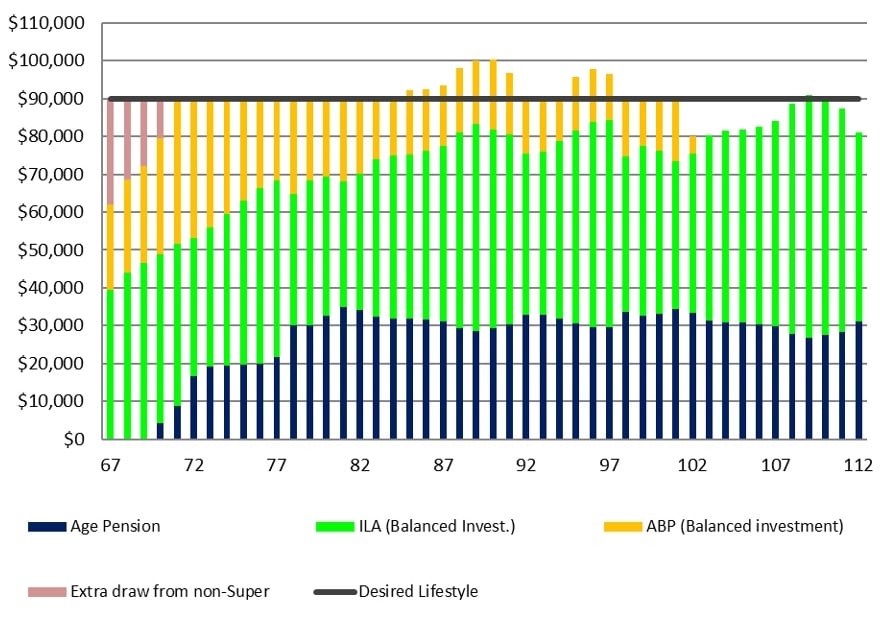

Option 3: Vanessa and Simon invest $700,000 into an ILA and $450,000 in ABPs

Retirement income breakdown (today’s dollars)

By combining the ILAs and ABPs, Vanessa and Simon would be able to meet their income goal of $90,000 per annum until age 101 years but then have a reduction to approximately $80,000.

The basis for this calculation was to allow for Vanessa to receive 65% of Simon’s lifetime income stream should he die before her, and Simon would receive 50% of Vanessa’s lifetime income stream should she die before him. As mentioned above, they consider this would allow either of them to meet their ongoing needs.

The use of the ILA means that they qualify for an Age Pension at age 70 years. The combination of the ILA with the ABP provides access to more cash (if other personal assets and savings from past pension receipts are insufficient). This gives them greater certainty about meeting any one-off unexpected spending needs, such as medical expenses or major house repairs not covered by insurance.

Even if they or one of them lives to over 103 years of age, they will still receive the benefit from the lifetime income streams as well as the Age Pension.

Which option provides the greatest income?

The table below shows the cumulative income in today’s dollars that Vanessa and Simon could expect from each of the three scenarios at their target planning age of 103. The table shows the income in five-year intervals from age 70, but the full breakdown is shown in our book. Of course, they will have either a shorter or longer actual lifetime than their joint life expectancy.

Comparison of the three options in today’s dollars to age 103

Option 1: 100% in an account-based pension (ABP)

| Age | Age Pension income | ABP income | Total annual income (including non-super drawdown) |

|---|---|---|---|

| 67 | $0 | $57,500 | $90,000 |

| 70 | $0 | $90,000 | $90,000 |

| 75 | $4,693 | $85,307 | $90,000 |

| 80 | $33,553 | $56,447 | $90,000 |

| 85 | $41,704 | $48,296 | $90,000 |

| 90 | $41,704 | $48,296 | $90,000 |

| 95 | $41,704 | $0 | $41,704 |

| 100 | $41,704 | $0 | $41,704 |

| Total to age 103 | $1,077,596 | $1,729,635 | $2,884,228 |

Analysis

Provides access to capital but ABPs run out at age 93. Totally reliant on Age Pension once the ABP run out.

Option 2: 100% in an investment-linked annuity (ILA)

| Age | Age Pension income | ILA income | Total annual income (including non-super drawdown) |

|---|---|---|---|

| 67 | $12,766 | $64,995 | $90,000 |

| 70 | $18,265 | $73,605 | $91,870 |

| 75 | $24,616 | $71,292 | $95,908 |

| 80 | $27,853 | $60,488 | $90,000 |

| 85 | $24,587 | $71,403 | $95,990 |

| 90 | $20,089 | $86,382 | $106,471 |

| 95 | $20,894 | $83,667 | $104,561 |

| 100 | $24,687 | $70,989 | $95,676 |

| Total to age 103 | $842,977 | $2,675,548 | $3,563,921 |

Analysis

Access to capital limited to private savings. Provides desired income for life.

Option 3: Account-based pension (ABP) plus investment-linked annuity (ILA)

| Age | Age Pension income | ABP income | ILA income | Total annual income (including non-super drawdown) |

|---|---|---|---|---|

| 67 | $0 | $22,500 | $39,504 | $90,000 |

| 70 | $4,186 | $30,588 | $44,738 | $90,000 |

| 75 | $19,708 | $26,961 | $43,331 | $90,000 |

| 80 | $32,539 | $20,696 | $36,765 | $90,000 |

| 85 | $31,862 | $17,015 | $43,399 | $92,276 |

| 90 | $29,357 | $18,577 | $52,504 | $100,437 |

| 95 | $30,597 | $14,370 | $50,853 | $95,820 |

| 100 | $33,084 | $13,768 | $43,147 | $90,000 |

| Total to age 103 | $953,239 | $717,341 | $1,626,208 | $3,374,315 |

Analysis

Product mix provides desired income until age 101. but reduced slightly from age 102 years. This option provides access to capital via the ABP and private savings.

Comparison of total income for all options

| Option 1: 100% in ABP | Option 2: 100% in an ILA | Option 3: ABP plus ILA | |

|---|---|---|---|

| Age | Total annual income (including non-super drawdown) | Total annual income (including non-super drawdown) | Total annual income (including non-super drawdown) |

| 67 | $90,000 | $90,000 | $90,000 |

| 70 | $90,000 | $91,870 | $90,000 |

| 75 | $90,000 | $95,908 | $90,000 |

| 80 | $90,000 | $90,000 | $90,000 |

| 85 | $90,000 | $95,990 | $92,276 |

| 90 | $90,000 | $106,471 | $100,437 |

| 95 | $41,704 | $104,561 | $95,820 |

| 100 | $41,704 | $95,676 | $90,000 |

| Total to age 103 | $2,884,228 | $3,563,921 | $3,374,315 |

| Analysis | Provides access to capital but ABPs run out at age 93. Totally reliant on Age Pension once the ABP run out. | Access to capital limited to private savings. Provides desired income for life. | Product mix provides desired income until age 101. but reduced slightly from age 102 years. This option provides access to capital via the ABP and private savings. |

Investing 100% of their super into a ABPs under Option 1 would give Vanessa and Simon the lowest total income at age 103, while putting 100% in an ILA under Option 2 would give Vanessa a marginally better income than Option 3 by investing in the mix of the ILA and ABP.

The trade-off is that the combination of products under Option 3 gives Vanessa and Simon greater access to cash (if other assets are insufficient) to meet their travel and other aspirations.

Making a recommendation

Marie reviews the results from the above charts and tables.

From a technical perspective:

- Marie decides she cannot recommend Option 1 (i.e. investment in an ABP only). Vanessa and Simon want to plan their retirement for 36 years and in the scenario above, it is projected they would run out of retirement savings from their ABP at age 93 and be reliant on the Age Pension after that. This is not consistent with either their desired retirement lifestyle or income needs.

- From an income perspective, in absolute dollar terms, there is little to choose between Option 2 (investing 100% in an ILA) and Option 3 (investing in a combination of an ILAs and ABPs). Both options provide them greater security that their income will not run out and they both provide earlier access to the Age Pension.

- If Vanessa and Simon invested all their super in an ILA, they can expect to receive a variable income which, in the scenario above, did not reduce below $90,000 a year at an average of just over $96,300 a year. However, they won’t have as much access to additional cash (if other assets are insufficient) for emergencies, apart from what they can save from their ongoing income

- If they invest in a combination of the two products, they have the flexibility of drawing down income from their ABP. This option can potentially achieve their planning target in terms of income and duration.

From a lifestyle perspective the ABP and ILA combination:

- Gives Vanessa and Simon the basic income they are seeking for life, with only a minor reduction in income much later in life.

- Gives a variable income of above $90,000 a year until age 102 when it reduces to just over $80,000.

- Provides them with earlier access to the Age Pension.

- If they live beyond the planned age for 90% confidence, i.e. 10% chance of living longer, then they will still have the Age Pension and ILA income.

- Gives them the ability to live independently of their children; with the ability to use the value of their home to secure residential aged care later in life if needed.

- Provides them with comfort that they won’t be a burden on their children.

- Allows them to leave a bequest to their children.

Marie believes that the combination of the ILA and the ABP will give Vanessa and Simon greater confidence that they will be able to receive their target income and undertake their desired lifestyle.

Marie is confident to recommend Option 3 to Vanessa and Simon.

This case study highlights that while ABPs used in isolation might allow full access to capital, they fail to adequately manage longevity risk (and FORO). It exemplifies the versatility of using newer products like ILAs, which can add income that is guaranteed to continue for life while at the same time facilitating an allocation to growth assets – with the investment risk/return benefits this can bring. Most importantly, it demonstrates the benefit of an integrated retirement solution tailored to each retiree’s unique needs and goals by blending different product characteristics.

As a professional financial planner, Marie has guided her clients through complex retirement decisions, assessing trade-offs, and constructing hybrid product strategies to maximise and manage their outcomes. The case study reinforces the value of financial advice in securing, sustainable retirement income solutions that clients and planners can be confident in.

This case study is just one of several in the book Retirement Income for Life: A Guide for Financial Planners.

The book is an essential guide for planners interested in building a secure retirement income strategy for their clients. It expertly addresses the challenges of rising life expectancy, providing strategic insights to ensure a confident and fulfilling retirement. The guide takes a practical approach to balancing client retirement lifestyle expectations with the range of retirement income options available in the Australian market, offering actionable steps to implement key principles. Real-world case studies bring these concepts to life, showcasing successful strategies that financial planners can readily apply.

Leave a comment

You must be a SuperGuide member and logged in to add a comment or question.