In this guide

MySuper average balance at $68,000

Average balances in superannuation remain relatively low, with the average member balance in a MySuper product at $68,000 as at the end of March 2024, according to the APRA’s Quarterly Superannuation Industry Publication.

The average member account balance in a choice accumulation product was $126,000, while the average balance was $216,000 in a choice transition-to-retirement product and $355,000 in a choice retirement product.

Of the $2.38 trillion total in superannuation assets, $1,006 billion was in 59 MySuper products, $1,224 billion was in 830 Choice products and $151 billion was in 122 defined benefit products.

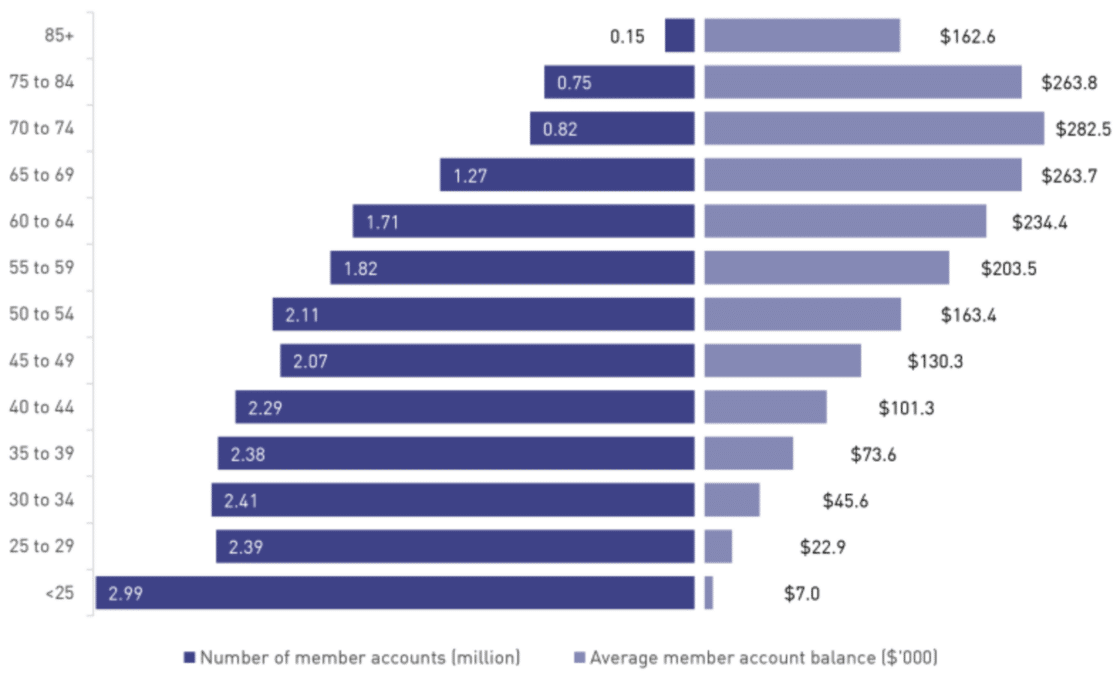

Across the age spectrum, the average balance of people younger than 40 was $73,600 or less, while those aged under 25 had average balances of just $7000.

Pre-retirees aged 60 to 64 had average balances of $234,400, while those aged between 70 and 74 had the highest average balances of $282,500.

Member Accounts and Average Balance by Age

Source: APRA

Even the highest average balances are less than half the $595,000 the ASFA Retirement Standard estimates is necessary to fund a comfortable lifestyle. While many retirees may well have sources of income outside super to draw on, the latest figures show the majority of retirees are likely to remain dependent on a full or part Age Pension for some time to come.

Total super assets up by 11.3%

Total superannuation assets increased by 4.2% over the quarter and 11.3% over the year to be $3.9 trillion, according to the latest quarterly superannuation data from the Australian Prudential Regulation Authority (APRA).

“This increase was led by strong growth in APRA-regulated funds, which increased by over 4.8% over the quarter, driven by strong returns from financial markets,” APRA said.

Of total superannuation assets, $2.7 trillion are in APRA-regulated funds.

Total contributions also increased by 11.3% over the year to $177 billion. Within contributions, employer contributions increased by 12.4% over the year to $133.3 billion as the superannuation guarantee rose from 10.5% to 11% on 1 July 2023, and member contributions increased by 8.2% over the year to $43.7 billion.

Albanese government passes financial advice laws

The Albanese government has passed the first tranche of its financial advice reform laws – Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Bill 2024.

The legislation is designed to streamline fee documentation into one simplified document, enable flexibility in how financial services guides are provided, and strengthen transparency and protections for consumers who receive personal advice about insurance products.

“Quality financial advice and information can support Australians to earn more and keep more of what they earn. Access to affordable advice protects consumers from scammers and can support them with cost-of-living pressures,” Assistant Treasurer and Minister for Financial Services, Stephen Jones, said in a media release.

The Government said the legislation clarifies that Australians can use their super accounts to pay for personal financial advice about their super from an independent financial adviser.

“The Government’s amendments will provide superannuation trustees greater legal certainty when deducting advice fees on behalf of superannuation consumers and will reduce the regulatory impact on financial advisers and advice businesses,” chief executive officer of the Financial Services Council Blake Briggs said.

“The amendments and supporting explanatory memorandum make it clear that trustees’ current risk-based approaches to assessing advice fee deductions remain appropriate,” he added.

Criminals targeting victims of previous scams

Reports of scams that involve a money recovery element are on the rise and the National Anti-Scam Centre is urging Australians who have had money stolen by scammers to be wary of offers to recover their money for an upfront fee.

Between December 2023 and May 2024, Scamwatch received 158 reports of such scams with total losses of over $2.9 million, including losses from the original scam.

That was a 129% increase in the number of reports compared to the six months prior, although financial losses decreased by 29% from $4.1 million.

Victims of previous scams are easily identified by criminals who commonly keep and sell information about individuals they have exploited. Older Australians are a frequent target with those aged 65 and over reporting the highest number of scams and suffering the highest average losses.

“Scammers pose as trusted parties such as government agencies, lawyers, or even charities. We are also aware of criminals pretending to be a victim themselves and claiming that a specific person or entity helped them get their money back,” ACCC deputy chair Catriona Lowe said.

70% of financial advisers pass exam

In the 25th cycle of the Financial Advisers Exam, held in June 2024, 235 people sat the exam, with 165 (70%) passing. Of those who sat the exam, 158 (67%) sat it for the first time.

The exam is conducted by Australian Council for Educational Research (ACER) and follows a process to ensure all candidates in each cycle are tested to the same standards.

To date, 21,260 individual candidates have sat the exam and 92% have passed, which ASIC says demonstrates they have the skills to apply their knowledge of advice construction, ethics and legal requirements to the practical scenarios tested in the exam.

New financial advisers must pass the financial adviser exam before starting the third quarter of their professional year to comply with the professional standards for financial advisers. Passing the exam is one of the education and training standards specified in section 921B of the Corporations Act 2001 (Corporations Act).

Australian ETFs continue to attract

Australian ETFs remain a popular choice for investors, with international shares topping the list of recent purchases.

ETF assets under management on the Australian Securities Exchange (ASX) and Cboe Australia grew by approximately 15% over the first half of 2024 to more than $200 billion as of 30 June.

Data released by the ASX and Vanguard shows Australian ETF assets rose by around $25 billion from the start of January to the end of June, with total ETF investor cash inflows on the ASX of $10.67 billion.

ASX-listed international equity ETFs were a popular choice with inflows totalling $5.28 billion while Australian equity ETFs attracted $2.95 billion over the half.

“The strong inflows into international equity ETFs evident over the March quarter accelerated during the June quarter, reflecting the eagerness of many Australian investors to capture the robust growth that has occurred on US share markets and other offshore markets,” said Vanguard’s head of ETF capital markets, Asia-Pacific, Adam DeSanctis.

“At the same time the investor inflows into Australian equity ETFs remained resilient, reflecting the positive performance of the broader domestic share market over the first half of the year.”

More work needs to be done by super funds on retirement outcomes

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) say that some significant gaps remain when it comes to super trustees tracking and measuring the impact of their retirement strategies to improve retirement outcomes for members.

APRA and ASIC have recently completed a pulse check of the implementation of the Retirement Income Covenant in which they invited 46 trustees to participate.

They found that while approximately three quarters of trustees indicated that measuring retirement outcomes was a priority, just eight trustees said tracking the effectiveness of retirement-focused assistance to members was a priority. What’s more, only one in five planned improvements identified by trustees were expected to be completed by mid-2024.

“The most concerning finding from this survey is the lack of progress being made by trustees in tracking the success of their strategies, especially as this was highlighted as one of the key areas in need of improvement in the thematic review report,” APRA deputy chair Margaret Cole said.

“Pleasingly, trustee responses to the survey indicate they are pushing ahead with work to refine their strategy implementation. However, we expect trustees to assess gaps and identify opportunities to accelerate progress in closing these gaps, including by leveraging examples of progress outlined in this industry update,” ASIC Commissioner Simone Constant said.

Leave a comment

You must be a SuperGuide member and logged in to add a comment or question.