In this guide

Choice super funds, where members actively choose investment options, have lifted their performance game overall but pockets of underperformance and high fees persist.

That is the finding of the Australian Prudential Regulation Authority’s (APRA) second annual Choice ‘heatmap’, which covers 163 super products and 604 distinct investment options representing $292 billion in member benefits.

Originally scheduled for release in December 2022 along with the MySuper heatmap, APRA delayed the Choice survey for the year to June 2022 to allow it to gather more data directly from super funds.

Both the Choice and MySuper heatmaps compare super products on investment performance, fees and costs, and sustainability.

APRA deputy chair Margaret Cole said despite showing some improvement, “there are still far too many [Choice accumulation] products delivering sub-standard investment returns to fund members.

“As a result, APRA’s supervision of poorly performing Choice products will intensify … Trustees with products that are underperforming or have unjustifiably high fees – or both – will need to explain why they haven’t already moved their members to products with better performance and better fee structures.”

How does the heatmap work?

The Choice Heatmap covers 47% of funds under management in the Choice accumulation sector, multi-sector investment options.

After collating information from these funds and investment options, the heatmap uses a graded colour system to visually compare how each product performs from white (alright) to burnt red (likely to burn a hole in members’ retirement savings).

Some of the key findings of APRA’s 2022 Choice Heatmap include:

- One in five Choice investment options with an eight-year history has significantly underperformed the heatmap benchmarks. Out of a total of 407 investment options, 182 underperformed while 80 of those underperformed the benchmarks by more than 0.5%. This was an improvement on the 2021 heatmap when one in four Choice investment options underperformed.

- Choice products that are closed to new members are more likely to underperform and have higher fees than those that are open. Two thirds of closed Choice investment options had poor or significantly poor performance relative to the heatmap benchmarks.

- Average fees for Choice products are higher than fees for My Super products. The average annual administration fee for members with a $50,000 account balance in a closed Choice fund was $225, compared with $149 for open Choice products and $137 for MySuper products.

It should be noted that some members may choose to stay in closed investment options for reasons other than performance, such as insurance offerings.

“Even so, APRA encourages all superannuation members to check whether they are satisfied with the outcomes they are getting from their chosen investment strategies,” says Cole.

Who is the heatmap for?

As it stands, the heatmap is aimed primarily at the super funds themselves, to spur underperforming funds to lift their game or face pressure from APRA to merge or leave the industry.

APRA says the intended audience also includes policymakers, advisers and employers. Certainly further refinements will be needed to make the heatmaps more accessible to fund members.

Although the heatmap is designed to highlight good and bad performance at a glance, it’s not that simple. To interpret the visuals, you need to wind your way through supporting material beginning with the Choice Heatmap Methodology Paper.

What is the difference between MySuper and Choice products?

MySuper products offer a single investment option and are designed to be simple, low-cost default products for members who don’t make an active decision on their investment strategy (although any member may choose to be in a MySuper product). As at June 2022, there were 69 MySuper products with 14.4 million member accounts and assets of $884 billion.

As mentioned earlier, Choice products and options are those in which members have made an active decision to invest and are aimed at people seeking greater control and flexibility. They are more diverse and complex than MySuper products and most often accessed via a financial adviser. Super fund trustees may offer multiple Choice products and within these products a wide range of investment options.

Choice investment options enable members to select investment options based on their risk profile, goals and personal circumstances. Choice members generally get access to a wider range of features than members of MySuper products, such as additional website functionality and member reporting.

Due to this wide range of Choice products, APRA’s Choice Heatmap only covers 47% of Choice accumulation products. That is, 163 products – including 604 investment options and 1,038 investment pathways – representing $292 billion in member benefits.

Investment returns are the primary driver of underperformance

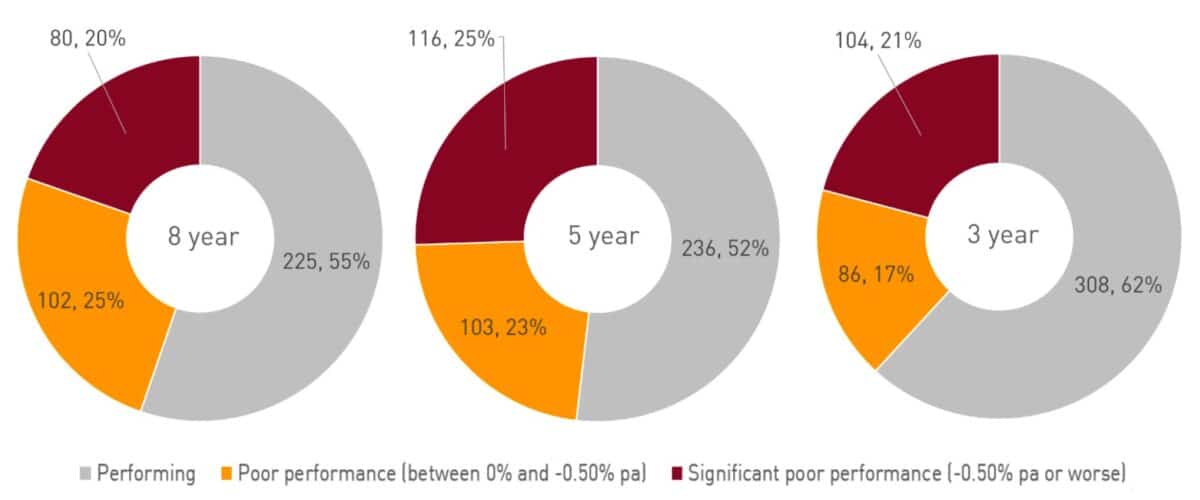

APRA argues performance should be looked at over a range of time horizons to see how products perform in different market environments. The latest heatmap assesses performance over three, five and eight years to 30 June 2022.

As you can see in the graphs below, investment returns even out over eight years compared with a shorter term of five years. Long-term returns are more relevant due to the long-term nature of superannuation.

Of the 604 multi-sector investment options covered, 407 have an eight-year history. Of those with an eight-year history, 182 (45%) underperformed relative to the heatmap benchmarks with 80 (20%) underperforming by more than 0.5% on average per year. You can see a list of the 80 significant underperformers by clicking the button below.

Choice super funds with significantly poor investment returns (8 years)

| RSE Licensee | RSE | Investment option name |

|---|---|---|

| AUSCOAL Superannuation Pty Ltd | Mine Superannuation Fund | Conservative Balanced Super |

| AUSCOAL Superannuation Pty Ltd | Mine Superannuation Fund | Growth Super |

| AUSCOAL Superannuation Pty Ltd | Mine Superannuation Fund | High Growth Super |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | FirstChoice Wholesale High Growth |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Perpetual Wholesale Balanced Growth |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Perpetual Wholesale Diversified Growth |

| AvSuper Pty Ltd | AvSuper Fund | Accumulation – High Growth |

| BT Funds Management Limited | Retirement Wrap | BT Super For Life Advance Conservative |

| BT Funds Management Limited | Retirement Wrap | BT Super For Life Advance Growth |

| BT Funds Management Limited | Retirement Wrap | BT Super For Life Advance Higher Growth |

| BT Funds Management Limited | Retirement Wrap | BT Super For Life Advanced Balanced |

| Energy Industries Superannuation Scheme Pty Ltd | Energy Industries Superannuation Scheme-Pool A | Conservative Balanced |

| Energy Industries Superannuation Scheme Pty Ltd | Energy Industries Superannuation Scheme-Pool A | Conservative |

| Energy Industries Superannuation Scheme Pty Ltd | Energy Industries Superannuation Scheme-Pool A | High Growth |

| Equity Trustees Superannuation Limited | Crescent Wealth Superannuation Fund | Crescent Wealth Super Balanced |

| Equity Trustees Superannuation Limited | Crescent Wealth Superannuation Fund | Crescent Wealth Super Conservative |

| Equity Trustees Superannuation Limited | Crescent Wealth Superannuation Fund | Crescent Wealth Super Growth |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Personal Retirement Plan – Matched |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Personal Retirement Plan – Secure |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Top Up Retirement Plan – Matched |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Top Up Retirement Plan – Secure |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Security Plan – Growth |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | RLA Personal Super Plan – Multi-manager Secure |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Balanced |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Balanced|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Defensive |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Secure |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Stable* |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Stable* |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Stable|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Stable|5 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|3 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|6 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|7 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|8 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Growth|9 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | High Growth|3 |

| Equity Trustees Superannuation Limited | SuperTrace Superannuation Fund | Capital Stable Fund |

| Equity Trustees Superannuation Limited | Zurich Master Superannuation Fund | ZRP BALANCED |

| Equity Trustees Superannuation Limited | Zurich Master Superannuation Fund | ZRP CAPITAL STABLE |

| Equity Trustees Superannuation Limited | Zurich Master Superannuation Fund | ZRP MANAGED GROWTH |

| Equity Trustees Superannuation Limited | Zurich Master Superannuation Fund | ZRP MANAGED SHARE |

| Nulis Nominees (Australia) Limited | MLC Super Fund | BlackRock Global Allocation Fund |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | ANZ Smart Choice Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | ANZ Smart Choice Moderate |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | BlackRock Diversified ESG Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | BlackRock Tactical Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Active Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Balanced |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Balanced Index |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Capital Stable |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Conservative |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Conservative Index |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Growth Index |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath High Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath High Growth Index |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Income |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Managed Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Tax Effective Income |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OptiMix Balanced |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OptiMix Conservative |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OptiMix Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OptiMix High Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OptiMix Moderate |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Pendal Monthly Income Plus |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Perpetual Balanced Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Perpetual Conservative Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Russell Balanced Class A |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | RUSSELL CAPITAL STABLE |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | RUSSELL DIVERSIFIED 50 CLASS A |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Schroder Fixed Income |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Schroder Real Return |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Schroder Strategic Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | UBS Balanced |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | UBS Defensive |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | UBS Diversified Fixed Income |

| Perpetual Superannuation Limited | Perpetual WealthFocus Superannuation Fund | Schroder Sustainable Growth super option |

| Rei Superannuation Fund Pty Limited | Rei Super | Conservative |

Source: APRA

*These investment options have the same reported name as other investment options offered by that RSE (within the same product and investment menu) but actually represent different underlying investment options.

Performance relative to heatmap benchmarks (% of options)

Source: APRA

Choice investment options are more likely to have underperformed than MySuper products, with closed Choice investment options particularly weak. Over 8 years, two thirds (67%) of closed Choice investment options fell below benchmark compared with 39% of open Choice investment options and just 21% of MySuper products.

Fees and costs remain high

APRA found higher fees are common in the Choice sector, especially among products closed to new members.

The median administration fee for closed Choice products is $350 for a member with a $50,000 balance, compared with $177 for open Choice products and $143 for MySuper products.

APRA found 48 Choice products with significantly higher fees and costs (above the crimson threshold across three or more account balances in the heatmap), accounting for 29% of all Choice products included in the survey. You can see a list of these products by clicking the button below.

Choice super funds with significantly high administration fees disclosed

| RSE Licensee | RSE | Product name |

|---|---|---|

| Diversa Trustees Limited | Future Super Fund | Verve Super Accumulation |

| Diversa Trustees Limited | Grosvenor Pirie Master Superannuation Fund Series 2 | Simple Choice Accumulation |

| Diversa Trustees Limited | Grosvenor Pirie Master Superannuation Fund Series 2 | Slate Super Accumulation |

| Diversa Trustees Limited | OneSuper | Australian Practical Superannuation Accumulation |

| Diversa Trustees Limited | OneSuper | Pearl YourChoice Complete Super Accumulation |

| Diversa Trustees Limited | OneSuper | RetireSelect Complete Super Accumulation |

| Diversa Trustees Limited | Tidswell Master Superannuation Plan | Cruelty Free Super |

| Diversa Trustees Limited | Tidswell Master Superannuation Plan | Spaceship Super |

| Diversa Trustees Limited | Tidswell Master Superannuation Plan | Student Super |

| Diversa Trustees Limited | Tidswell Master Superannuation Plan | Superestate |

| Equity Trustees Superannuation Limited | AMG Super | Acclaim Super |

| Equity Trustees Superannuation Limited | Aracon Superannuation Fund | Elevate Accumulation |

| Equity Trustees Superannuation Limited | Crescent Wealth Superannuation Fund | Crescent Wealth Superannuation Fund |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Goldline Personal Superannuation Plan |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Personal Superannuation Plan |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Personal Retirement Plan |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Top Up Retirement Plan |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Security Plan |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | RLA Personal Super Plan |

| Equity Trustees Superannuation Limited | Smart Future Trust | smartMonday DIRECT – Choice |

| Equity Trustees Superannuation Limited | Super Retirement Fund | CPSL Master Fund Superannuation |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Personal Superannuation & Rollover Plan|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Personal Superannuation & Rollover Plan|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver Series 2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver Series 2|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver Series 2|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Retirement Saver|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Select Personal Superannuation|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Select Personal Superannuation|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperSelect |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperWise Series 4|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperWise Series 4|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperWise Series 5|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperWise Series 5|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | SuperWise Series 5|3 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Umbrella Financial Plan Super|1 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Umbrella Financial Plan Super|2 |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Umbrella Investment Plan Super |

| Equity Trustees Superannuation Limited | Zurich Master Superannuation Fund | Zurich Superannuation Plan (ZSP) |

| LGSS Pty Limited | Local Government Super | Active Super Accumulation Scheme |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | ANZ Super Advantage |

| Prime Super Pty Ltd | Prime Super | Choice – accumulation |

| SPSL Limited | SPSL Master Trust | Suncorp Brighter Super |

| SPSL Limited | SPSL Master Trust | Suncorp Brighter Super for business |

| Towers Watson Superannuation Pty Ltd | Nissan Superannuation Plan | DC Division |

However, most of these high-cost products have assets less than $10 million and lower levels of member benefits, illustrating the difficulties faced by smaller funds without the economies of scale required to compete on fees and costs.

Not surprisingly, closed products with significantly high fees tend to underperform relative to investment benchmarks.

Sustainability a challenge

Financial sustainability remains a challenge for a large part of the superannuation sector, including Choice funds.

Choice product providers that don’t also offer MySuper products tend to have weaker sustainability ratings, as do those that are closed to new members. They also tend to be smaller funds.

APRA notes that: “Sufficient scale is required to support efficient and resilient business models, keep fees and costs low, and finance operational and service improvements expected by their members and APRA.”

These funds are likely to come under increased pressure from APRA merge or transfer members to better performing options.

Leave a comment

You must be a SuperGuide member and logged in to add a comment or question.