SuperGuide member support

If you have any questions about SuperGuide or your subscription, please browse through the relevant support questions below.

About SuperGuide

Learn more about SuperGuide membership, what is included and how it can help you.

SuperGuide is a service providing up-to-date analysis and information on superannuation (including SMSFs), retirement planning and the Age Pension.

As a subscriber, you can expect regular newsletters and updates, access to a curated and indexed library of 500-plus regularly updated articles, and of course new articles and analysis every month.

You will also have immediate access to calculators and reckoners, how-to guides, strategies and other tools.

SuperGuide is designed for anyone thinking about growing their super balance (including Australians running self-managed super funds) or anyone planning for, or living in retirement.

The language used in the superannuation and retirement planning space can be complex, the rules often change, and most Australians are trying to plan ahead for a retirement that could last 30 to 40 years. Over the past 15 years, we have developed SuperGuide into a comprehensive, easy-to-understand and up-to-date resource, while also providing the latest news and analysis on super and retirement changes.

SuperGuide provides members with independent analysis and information on super and retirement planning, in a world where such analysis is becoming increasingly rare.

Some of the questions SuperGuide helps you answer include:

- What are the latest super and retirement changes, and how do they affect me?

- How much will I need to retire, and can I afford to retire early?

- What can I do now to prepare for the kind of retirement I want?

- What super strategies are the most appropriate for my age and situation?

- What are the latest super and tax rates and thresholds?

- How do I run my SMSF according to the super rules?

- I’m retired. How can I manage my super and other entitlements?

- How do I apply for the Age Pension, or work out what benefits I’m entitled to?

- What were the top performing super and pension funds, over 1 year, 5 years and 10 years?

As a SuperGuide member you will have to access to:

- Comprehensive library of guides explaining super and retirement rules in straightforward language – we have done the translation work for you.

- Regular updates on new tools, and special features of the site

- Up-to-date expert analysis and commentary on the latest super, retirement and Age Pension changes

- Step-by-step guides, checklists, tips, strategies, Q&As and case studies

- Interactive tools, quizzes, calculators and videos on key super and retirement planning topics

- Monthly webinars which tackle key topics in comprehensive detail

- Monthly email newsletters with additional special editions (Federal Budget, New financial year)

- Ability to save articles to your account, or print for reading offline

- Advertisement-free articles so we can provide clearer information, with less distraction

We offer three different plans which are designed for three different lifestages.

Super booster – $55 per year

- When retirement is a long way off and you just want to grow your super

- This includes access to the How super works and Super funds sections

- Super booster newsletter each month, and at least 2 webinars per year

Retirement planner – $95 per year

- When you are starting to plan your retirement, through to the first years of retirement

- This includes access to the How super works, Super funds, Retirement planning and In retirement sections

- Super booster, Retirement planner and Retiree newsletters each month, and at least 6 webinars per year

Retiree – $65 per year

- When you have already retired and want to boost your income in retirement

- This includes access to the How super works, Super funds and In Retirement sections

- Super booster and Retiree newsletters each month, and at least 4 webinars per year

SMSFs

If you have an SMSF or are interested in starting one you can also purchase access to our SMSF section as an optional add-on to any of the above plans for an additional $50 per year. You also receive the SMSF newsletter each month and an additional 6 SMSF-focused webinars per year.

This means the pricing per plan including SMSFs access is as follows:

- Super booster + SMSF = $105 per year

- Retirement planner + SMSF = $145 per year

- Retiree + SMSF = $115 per year

While we do review all questions that are sent to us, it’s not possible for us to answer all of them, mainly due to the large number of emails and questions that we receive.

SuperGuide members can also submit questions to our quarterly Q&A webinars.

We review all questions because they are a valuable way for us to understand the most common questions that SuperGuide readers have. We use those questions as a basis for our articles and also, where applicable, creating new tools for subscribers. Taking this approach ensures we can deliver comprehensive coverage of super and retirement issues.

Importantly it’s important to note that we are not permitted to provide personal financial advice, so we can only ever discuss rules in a general way.

SuperGuide is an independent company owned and operated by Robert Barnes, who co-founded the service in 2008.

Robert has worked with some of Australia’s top websites including realestate.com.au, First Digital (home to Business Spectator, Crikey, Smart Company and Eureka Report), and overseas for Universal Music and Hill and Knowlton.

You can learn more about about the team that run SuperGuide here.

How to use SuperGuide

Includes topics such as how to login, how to change your password, how to save articles.

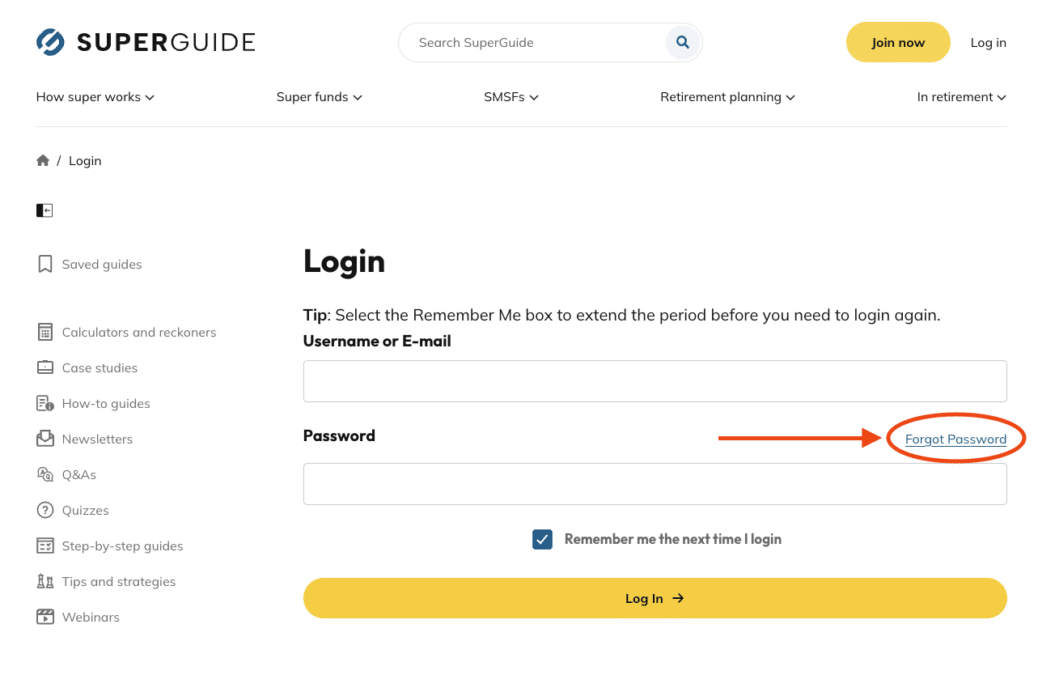

Go to this page to login.

We recommend you tick the Remember Me box to extend the period that you stay logged in for.

Please refer to the FAQ below if you have forgotten your username or password.

Your username will be the email address that you signed up with. Please contact us (usingthe form to the right) if you cannot remember the email address you used for your subscription.

If you’ve forgotten your password, click the Forgot Password link below the Log In button on the login page.

You will then be prompted to enter your email address. You should then click the Request Password Reset button.

You will then receive an email with a link. Once you click that link you can enter a new password.

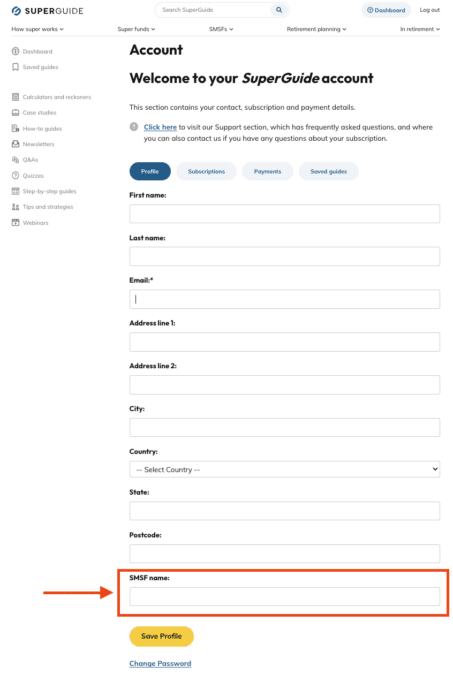

You can change your password within your SuperGuide Account page.

Click Profile, and then at the bottom you will find a link to Change Password. Simply click this and follow the instructions.

Please refer to the FAQ above if you have forgotten your username or password.

It may be that the newsletter email is stuck in your junk or spam folder.

If you add contact@superguide.com.au and newsletter@superguide.com.au to your address book within your email provider, this can also help improve email deliverability.

If you still cannot find the newsletter email, please contact us and we can check that it is being sent to the correct address.

Please note that you can also view all previous SuperGuide newsletters here.

Saving guides

You can save and remove any guide by clicking the bookmark button.

You can then view your saved guides here, which can also be found by clicking the Saved guides button in the left sidebar.

Your SuperGuide subscription

Covers billing questions including how to purchase a subscription or how to get a refund.

Payments

You can pay by credit or debit card (Visa, Mastercard and American Express), PayPal or bank transfer.

You can learn more about our different membership plans here.

SuperGuide offers a 30 day no questions asked money back guarantee.

Please contact us (using the form to the right) if you would like to be refunded for your SuperGuide subscription.

Yes you can change subscription plans at any time, and any remaining value from your subscription is discounted from your new plan.

For example, if you have already purchased the Super booster plan ($55 per year), and exactly halfway through the year you decide to change to the Retirement planner plan ($95 per year), you would be credited $27.50 for the remaining value of the Super booster subscription.

You would then be charged $67.50 ($95 minus $27.50) for the Retirement planner subscription.

Please note that the amount you will be credited will vary, depending on exactly when you change plans. The earlier in your subscription that you change, the more you will be credited.

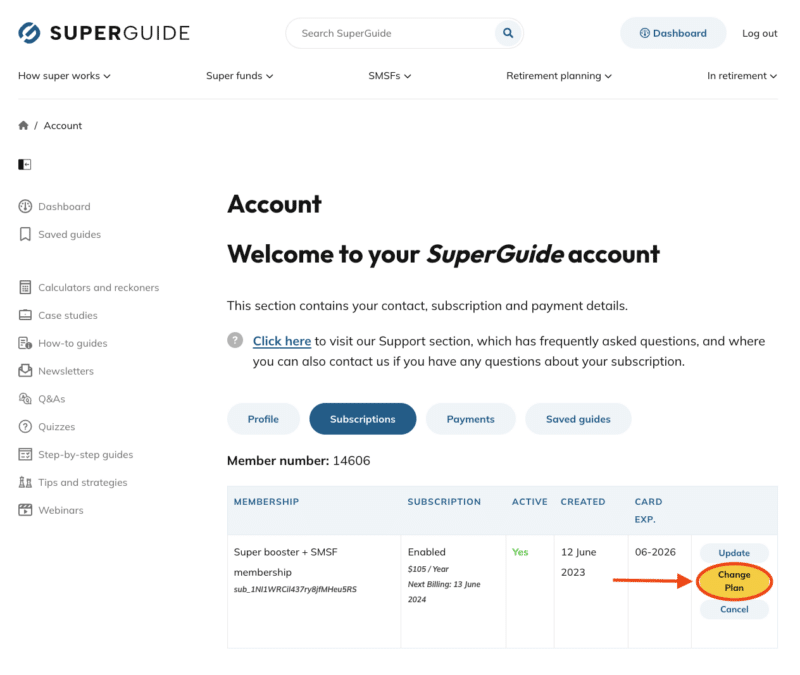

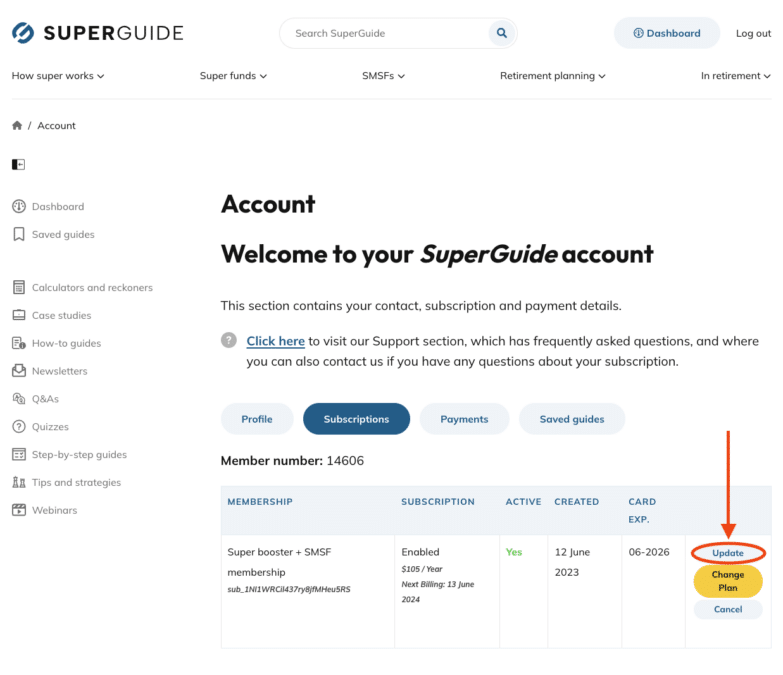

How to change plans

- Go to your account page (you will need to be logged in).

- Click on Subscriptions, then Change Plan.

3. Select your new plan, and proceed through the payment steps.

Please contact us (using the form to the right) if you have any questions or problems changing your subscription.

Yes. When you select a plan you can select an option to pay by bank transfer (rather than by credit card or PayPal).

You will be sent an email with our bank payment details.

Due to bank processing times, access to SuperGuide may not occur for up to 2 working days for subscribers paying by bank transfer.

If you require urgent access to SuperGuide before your payment is processed, please contact us (using the form to the right) and we will try to arrange early access.

You can get immediate access to SuperGuide if you pay by credit card, debit card or PayPal.

When you first subscribe to SuperGuide, subscriptions are set to automatically renew, either annually or monthly, depending on which subscription you select. Benefits of this are that you don’t need to confirm your payment details again each time your subscription renews, and also your subscription fee stays the same, even when our prices increase.

You can very easily cancel future renewals at any time if you don’t wish to set up recurring payments though. See the FAQ below for details on now to cancel your subscription.

For annual subscriptions, you will be notified by email 30 days before your subscription is due for renewal, letting you know that your subscription renewal will be deducted from your account. You will receive an email receipt on payment.

For monthly subscriptions, you will be notified by email 7 days before your subscription is due for renewal, letting you know that your subscription renewal will be deducted from your account. You will receive an email receipt on payment, and you can convert your subscription to an annual subscription at any time.

Your SuperGuide account is where you can see details of your subscription, including when it started and when it is due for renewal.

You can also cancel your subscription on your account page, or just contact us (using the form to the right) and we can cancel it for you. Either way you will receive confirmation of you cancellation by email.

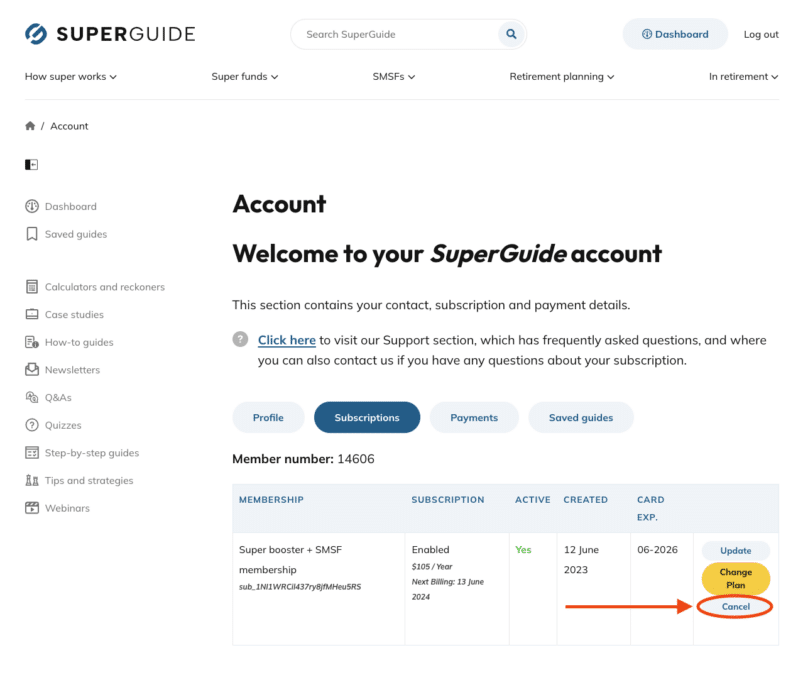

You can login to your account and cancel at any time.

- Go to your account page (you will need to be logged in).

- Click on Subscriptions, then Cancel.

Alternatively you can contact us (using the form to the right) and we can cancel it for you.

Your account access will still be available until your current subscription period ends.

SuperGuide does not store a copy of your credit card. All credit and debit card payments are processed by Stripe, a secure, online payment system that SuperGuide uses to process credit or debit card payments for subscriptions.

Stripe has been audited and certified as a PCI compliance Level 1 service provider, which is the most stringent level of certification available in the payments industry.

Stripe processes billions of dollars a year for thousands of businesses, including Amazon, Apple, Deliveroo, Google, IBM and Xero.

The only information SuperGuide can access about your credit card are the last 4 digits and the expiry date. We use this information to help members identify which card was used for their subscription and when it expires.

If you’d like to change or update your credit card information then you can do so by logging in at the page below, and then going to the subscription section of the account page:

You should then click the “Subscriptions” button, then the “Update” button, and this will allow you to update your credit card information.

Stripe is a secure, online payment system that SuperGuide uses to process credit or debit card payments for subscriptions.

Stripe has been audited and certified as a PCI compliance Level 1 service provider, which is the most stringent level of certification available in the payments industry.

Stripe processes billions of dollars a year for thousands of businesses, including Amazon, Apple, Deliveroo, Google, IBM and Xero.

The annual subscription covers 12 months from the day you sign up. So if you sign up on 14th October 2022, you will have access until 13th October 2023.

The minimum subscription period is simply your initial subscription period.

For example, you can just subscribe for one year if you wish and you can cancel at any time.

If you cancel before the end of a billing period, you’ll retain access until that billing period is over.

At this stage we are only accepting annual subscriptions, but we are considering offering this option sometime in the future.

Tax and deductions

The ATO allows for general deductions as part of the expenses of running an SMSF, to the extent that:

- it is incurred in gaining or producing assessable income

- it is necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income.

Subscriptions are included as examples of these expenses.

If you are planning to claim a tax deduction for your SuperGuide subscription, you will need to confirm your personal tax situation with your accountant or the ATO.

Note: You can add the name of your SMSF when you first subscribe to SuperGuide. If you have not yet added your SMSF name you can do this through your Account page.

The ATO allow you to claim an immediate deduction up to $300 for books, periodicals and digital information that are “used predominantly for earning assessable income that is not income from carrying on a business”.

If you are planning to claim a tax deduction for your SuperGuide subscription, you will need to confirm your personal tax situation with your accountant or the ATO.

You will be emailed a receipt for your subscription when your payment is received. This receipt can also be used as a tax invoice.

Please contact us (using the form to the right) if you don’t receive this receipt and we can send a copy to you.

SuperGuide does not store a copy of your credit card. All credit and debit card payments are processed by Stripe, a secure, online payment system that SuperGuide uses to process credit or debit card payments for subscriptions.

Stripe has been audited and certified as a PCI compliance Level 1 service provider, which is the most stringent level of certification available in the payments industry.

Stripe processes billions of dollars a year for thousands of businesses, including Amazon, Apple, Deliveroo, Google, IBM and Xero.

The only information SuperGuide can access about your credit card are the last 4 digits and the expiry date. We use this information to help members identify which card was used for their subscription and when it expires.

Yes. On receipt of payment we send you a receipt that specifies the GST that has been paid.