YOUR TRUSTED, INDEPENDENT SMSF GUIDE

Super booster + SMSF

$105 per year

SelectRetirement planner + SMSF

All Access$145 per year

SelectRetiree + SMSF

$115 per year

Select5 reasons to become a member today

Make confident SMSF decisions for retirement

Whether you’re preparing for retirement or already retired, get clear guidance on the SMSF rules that matter most — including contributions, investing, pensions and tax.

Get independent, expert explanations

We simplify complex SMSF topics such as pension requirements, transfer balance considerations, strategy and compliance so you can avoid costly mistakes.

Understand the rules without the complexity

Our straightforward guides break down SMSF strategies, tax outcomes, pension rules and retirement planning steps in a way that’s easy to follow.

Stay compliant and in control

Access practical checklists and templates that help you stay on top of your SMSF admin, documentation, pension reporting and annual obligations.

Support at every stage of your SMSF journey

From building your balance to managing retirement income, pensions and later-life SMSF decisions, SuperGuide helps you make informed choices with confidence.

What’s included in your SMSF toolkit?

Comprehensive super and SMSF rules

Clear explanations of contributions, investment strategy, compliance requirements, tax outcomes and the key SMSF pension rules you’ll need as you approach or live in retirement.

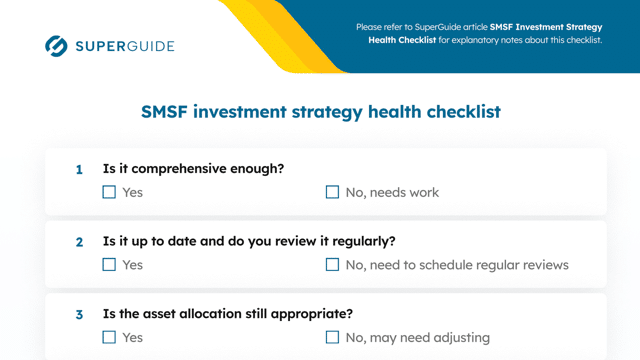

SMSF checklists

Stay on top of SMSF admin with practical checklists covering documentation, compliance, year-end tasks and important pension considerations.

Step-by-step guides

Follow simple guides that walk you through SMSF strategies, tax planning, investment decisions, contribution timing and key retirement topics such as starting or managing pensions.

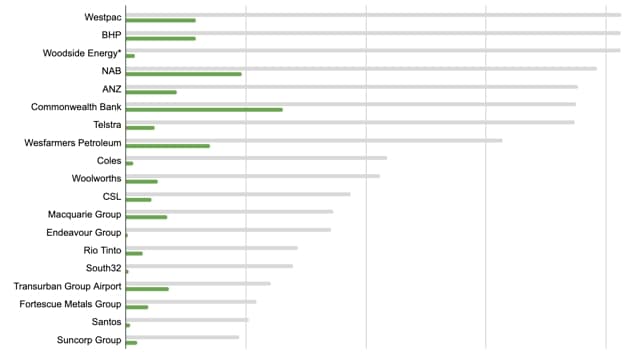

SMSF investing guides

Learn how to invest confidently inside your SMSF — whether you’re building wealth or planning for retirement income through pension phase.

Interactive tools and calculators

Our intuitive tools and calculators give you the power to plan and make your retirement goals a reality.

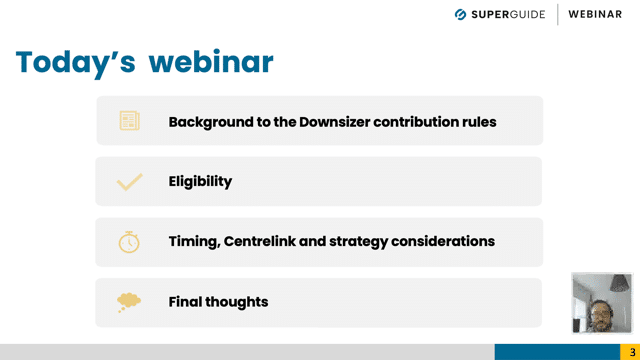

Webinars and newsletters

Stay up to date with rule changes and practical SMSF guidance, including investing, admin, tax updates and important pension and retirement insights.

Super booster + SMSF

$105 per year

SelectRetirement planner + SMSF

All Access$145 per year

SelectRetiree + SMSF

$115 per year

SelectWhat makes SuperGuide different

We’re independent

We’re experts

We’re comprehensive

Frequently asked questions

If you have any further questions, please get in touch.

What is included in a SuperGuide membership?

SuperGuide is Australia’s most trusted superannuation and retirement planning platform, providing up-to-date analysis and insights on super, SMSFs, retirement planning and the Age Pension.

Expect hundreds of fact-checked resources, practical strategies, checklists, case studies, Q&As, interactive tools and our monthly members-only newsletters and webinars.

How much does SuperGuide cost?

SuperGuide has three different plans which are designed for three different lifestages.

Super booster – $55 per year

- When retirement is a long way off and you just want to grow your super

- This includes access to the How super works and Super funds sections

Retirement planner – $95 per year

- When you are starting to plan your retirement, through to the first years of retirement

- This includes access to the How super works, Super funds, Retirement planning and In retirement sections

Retiree – $65 per year

- When you have already retired and want to boost your income in retirement

- This includes access to the How super works, Super funds and In Retirement sections

SMSFs

If you have an SMSF or are interested in starting one you can also purchase access to our SMSF section as an optional add-on to any of the above plans for an additional $50 per year.

This means the pricing per plan including SMSFs access is as follows:

- Super booster + SMSF = $105 per year

- Retirement planner + SMSF = $145 per year

- Retiree + SMSF = $115 per year

How do I cancel my SuperGuide membership?

You can login into your account and cancel at any time. Your account access will still be available until your current subscription period ends.

Can I claim my membership as an SMSF expense or get a tax deduction?

The ATO allows for general deductions as part of the expenses of running an SMSF, to the extent that:

- it is incurred in gaining or producing assessable income

- it is necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income.

Subscriptions are included as examples of these expenses.

If you are planning to claim a tax deduction for your SuperGuide membership, you will need to confirm your personal tax situation with your accountant or the ATO.

The ATO also allow you to claim an immediate deduction up to $300 for books, periodicals and digital information that are “used predominantly for earning assessable income that is not income from carrying on a business”.

Super booster + SMSF

$105 per year

SelectRetirement planner + SMSF

All Access$145 per year

SelectRetiree + SMSF

$115 per year

Select