YOUR TRUSTED, INDEPENDENT RETIREMENT GUIDE

30 day money back guarantee

If for any reason you want to cancel your membership, just let us know within 30 days and we will refund you in full (no questions asked).

5 reasons to become a member today

Make your finances last longer

It’s critical that your super is still working hard for you in retirement, but it’s also important to consider other sources of income. Use SuperGuide’s tools to check your eligibility for the Age Pension and other benefits, understand the impact of working in retirement or even unlocking value from your home.

Make more informed decisions

When you retire, you still have a lot of important decisions to make, whether it’s how to spend your super, estate planning or aged care. The choices you make can have a big impact, so it pays to be informed.

Get guidance from independent experts

SuperGuide’s team of experts have your best interests at heart. We’re completely independent, so you get unbiased information you can trust.

Retirement doesn’t just happen

Starting and managing a pension is a new thing to learn, and it doesn’t stop there. Managing your investments properly through retirement is critical to ensure your super lasts as long as possible. It almost sounds like work, but our straightforward guides help you every step of the way.

Membership pays for itself

SuperGuide is great value and can save or earn you money, whether it’s better returns in retirement or understanding the concessions available to seniors.

What makes SuperGuide different

For the last 15 years we’ve been uniquely placed to help Australians make the most of their superannuation and achieve their retirement goals

We’re independent

We’re experts

We’re comprehensive

30 day money back guarantee

If for any reason you want to cancel your membership, just let us know within 30 days and we will refund you in full (no questions asked).

What’s included in your SuperGuide membership?

Tips and strategies

Get expert tips and strategies on how to make the most of your super savings and navigate your retirement.

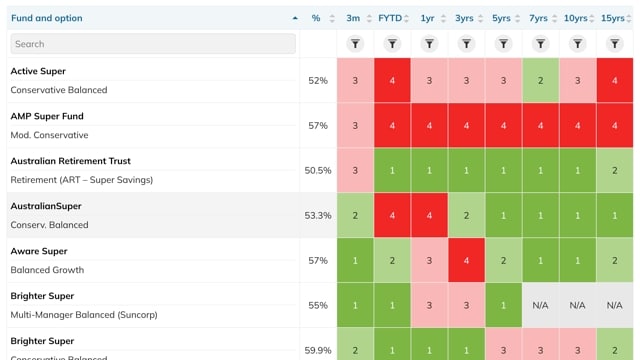

Pension fund rankings

Compare your fund against the latest pension fund performance rankings and choose the fund that’s right for you.

Up-to-date rules

Stay on top of all the super and Age Pension rule changes – simplified and in one place.

Interactive tools and calculators

Our intuitive tools and calculators can help you improve your income in retirement and make your super last longer.

Webinars and newsletters

Stay on top of changes. Understand the changes that impact you with webinars and newsletters with all the information you need.

Frequently asked questions

If you have any further questions, please get in touch.

What is included in a SuperGuide membership?

SuperGuide is Australia’s most trusted superannuation and retirement planning platform, providing up-to-date analysis and insights on super, SMSFs, retirement planning and the Age Pension.

Expect hundreds of fact-checked resources, practical strategies, checklists, case studies, Q&As, interactive tools and our monthly members-only newsletters and webinars.

How much does SuperGuide cost?

SuperGuide has three different plans which are designed for three different lifestages.

Super booster – $55 per year

- When retirement is a long way off and you just want to grow your super

- This includes access to the How super works and Super funds sections

Retirement planner – $95 per year

- When you are starting to plan your retirement, through to the first years of retirement

- This includes access to the How super works, Super funds, Retirement planning and In retirement sections

Retiree – $65 per year

- When you have already retired and want to boost your income in retirement

- This includes access to the How super works, Super funds and In Retirement sections

SMSFs

If you have an SMSF or are interested in starting one you can also purchase access to our SMSF section as an optional add-on to any of the above plans for an additional $50 per year.

This means the pricing per plan including SMSFs access is as follows:

- Super booster + SMSF = $105 per year

- Retirement planner + SMSF = $145 per year

- Retiree + SMSF = $115 per year

How do I cancel my SuperGuide membership?

You can login into your account and cancel at any time. Your account access will still be available until your current subscription period ends.

Can I claim my membership as an SMSF expense or get a tax deduction?

The ATO allows for general deductions as part of the expenses of running an SMSF, to the extent that:

- it is incurred in gaining or producing assessable income

- it is necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income.

Subscriptions are included as examples of these expenses.

If you are planning to claim a tax deduction for your SuperGuide membership, you will need to confirm your personal tax situation with your accountant or the ATO.

The ATO also allow you to claim an immediate deduction up to $300 for books, periodicals and digital information that are “used predominantly for earning assessable income that is not income from carrying on a business”.

30 day money back guarantee

If for any reason you want to cancel your membership, just let us know within 30 days and we will refund you in full (no questions asked).