In this guide

Self-managed superannuation fund (SMSF) trustees should be familiar with their requirements to have an investment strategy in place, but it can be difficult to know where to start if you've never done one before.

Learn how to write your SMSF investment strategy.

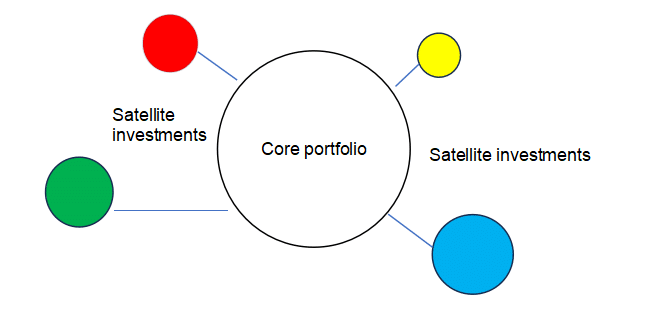

One easy-to-understand approach, which many SMSF trustees use, is called a core and satellite investment strategy. It aims to stabilise returns and aid diversification while reducing risk by limiting the percentage of your portfolio you can invest in riskier investments.

Harnessing a universe of investment options

The core satellite approach involves investing in a core of low risk, usually low-cost stable investments, combined with investments in 'satellite' or riskier options that may deliver higher returns, as the diagram below illustrates.

Solar system approach

If you think of your portfolio as a solar system, then the sun is your core portfolio and the smaller planets orbiting it are your satellite investments.

How you allocate your portfolio to core and satellite investments will depend on your investment preferences and personal circumstances, but a common approach is to invest 80% in a core portfolio of equities, bonds and cash and 20% in satellite investments.

If you start with this kind of approach, and stick to it, you will make sure you don't bet the house, that is, all your SMSF funds, on that 'once-in-a-lifetime opportunity' that Uncle Steve is recommending.