In this guide

SuperGuide members also have access to a video explainer which details a 5 step process to make the most of your super contributions.

Learn more about the benefits when becoming a member.

Making super contributions to build a nest egg for your retirement sounds easy but working out the best mix of concessional and non-concessional contributions for your particular situation can be difficult.

Luckily, there are some general principles you can use when working out your personal contribution mix.

To give you some ideas, we’ve also created a few case studies of typical Aussies of different ages, income levels, and work situations. These are designed to illustrate the impact of the different strategies you can use, rather than providing specific examples you should follow.

As the rules around the super system change constantly, your contribution mix should be regularly reassessed to ensure you get the best outcome for your current financial situation.

What types of super contributions can I make?

Before trying to work out your best mix of super contributions, here’s a quick reminder of the main types of contributions, plus some links to our articles explaining things in more detail if you need to refresh your memory:

1. Concessional (before-tax) contributions

These contributions are made from your income before you pay income tax.

There is a 15% contributions tax payable on these contributions when they are added to your super account, which for people on medium or high incomes, is less than their marginal income tax rate.

The total amount you may contribute per financial year at this low tax rate is limited by the annual cap ($30,000 in 2024–25), but if you’re eligible to carry forward unused cap space from previous years you can contribute even more without attracting further taxes.

Need to know – Division 293

If your total income plus concessional contributions is above $250,000 in a financial year, you are liable for additional tax on your concessional contributions. It is important to be aware that your total income for this purpose is not only your taxable income but includes other items such as investment losses and fringe benefits.

Learn more about Division 293 tax.

The main types of concessional contributions are:

- Your employer’s Super Guarantee (SG) contributions

- Award and additional employer contributions

- Salary-sacrifice contributions

- Personal contributions for which you claim a tax deduction.

Learn about the SG contributions rate and rules.

Check out the benefits of salary sacrifice and super.

Read how tax-deductible contributions work.

2. Non-concessional (after-tax) contributions

These super contributions are made from your income after you pay income tax.

There is no 15% contributions tax payable on these contributions as you have already paid tax on the money. You may contribute up to the annual non-concessional cap in one financial year without triggering additional tax, and most people are eligible to contribute more using the bring forward rule.

In 2024–25, the annual cap is $120,000, or zero if your total super balance was $1.9 million or more on 30 June 2024.

The main types of non-concessional contributions are:

- Personal contributions from your take-home pay

- Spouse contributions.

Learn more about non-concessional super contributions and boosting your spouse’s super.

3. Government contributions into your super account

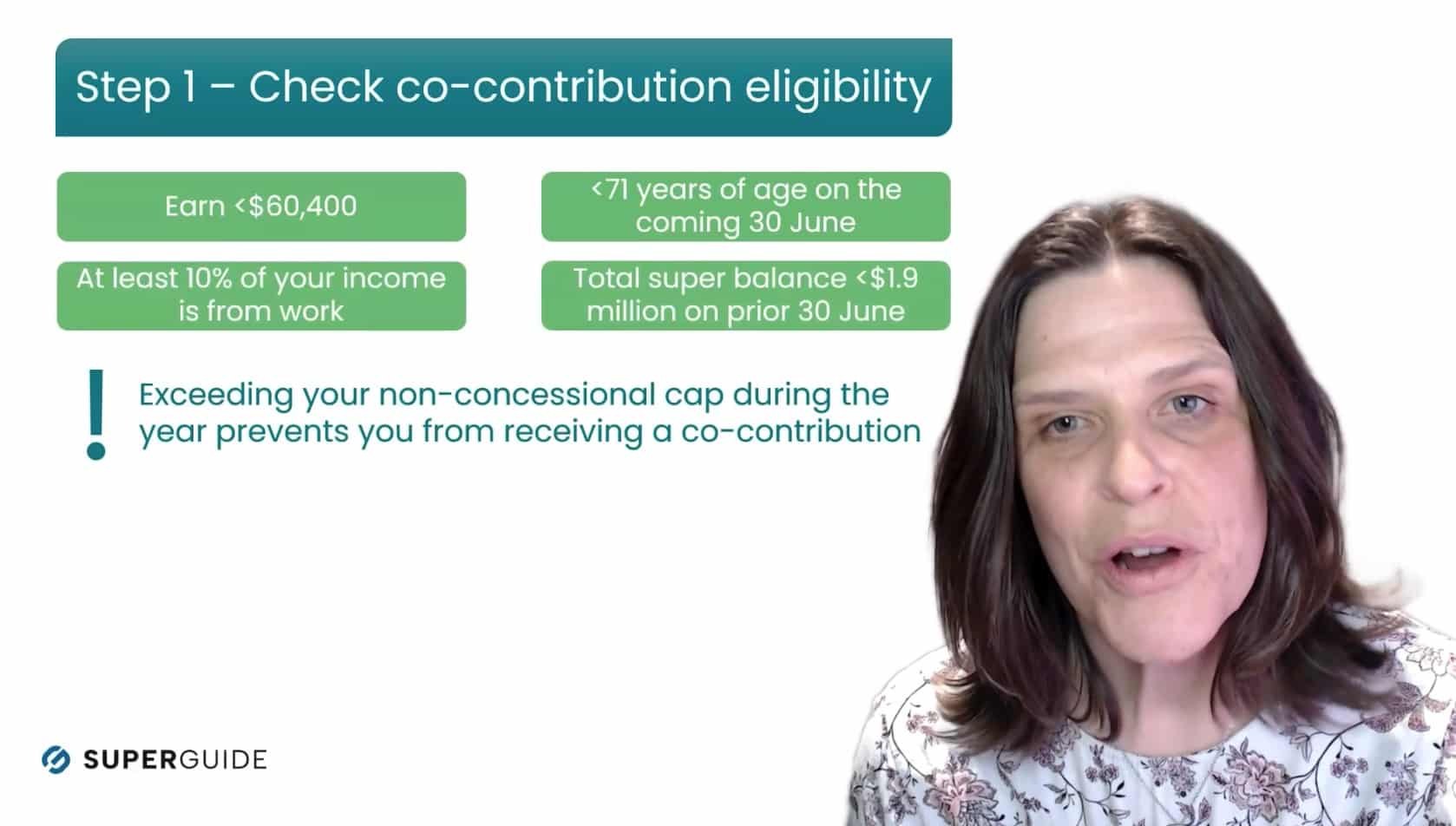

These contributions are made by the government directly into your super account if you meet the eligibility criteria and they can provide a useful boost to your retirement savings (see following case studies):

- Co-contributions

- Low income super tax offset (LISTO)

Learn more about government co-contributions and the Low Income Superannuation Tax Offset (LISTO).